Increased Collaboration Among Industry Players

Increased collaboration among industry players is a notable driver of the Germany Extreme Ultraviolet Euv Lithography Market. Partnerships between semiconductor manufacturers, equipment suppliers, and research institutions are becoming more common as stakeholders seek to leverage each other's expertise. Such collaborations facilitate knowledge sharing and accelerate the development of innovative EUV lithography solutions. For instance, joint ventures between leading German semiconductor firms and international technology providers have been established to enhance the capabilities of EUV systems. This collaborative approach not only fosters innovation but also strengthens the overall competitiveness of the German semiconductor industry in the global market, positioning it as a leader in EUV lithography technology.

Supportive Government Policies and Initiatives

The German government has implemented various policies and initiatives to bolster the Germany Extreme Ultraviolet Euv Lithography Market. These measures include funding for research and development in semiconductor technologies, as well as incentives for companies investing in EUV lithography equipment. The government aims to enhance the country's competitiveness in The Extreme Ultraviolet Euv Lithography, which is projected to grow significantly in the coming years. For instance, the German Federal Ministry of Education and Research has allocated substantial resources to support innovation in lithography technologies. Such government backing not only fosters a conducive environment for industry growth but also encourages collaboration between public and private sectors, further strengthening the EUV lithography ecosystem.

Technological Advancements in Lithography Equipment

Technological advancements in lithography equipment are driving the growth of the Germany Extreme Ultraviolet Euv Lithography Market. Manufacturers are continuously innovating to enhance the performance and efficiency of EUV lithography systems. Recent developments have led to improved light sources and optics, which are critical for achieving higher resolution and throughput in semiconductor manufacturing. In 2025, the market for EUV lithography equipment in Germany was estimated to reach 5 billion euros, reflecting the increasing adoption of this technology by local semiconductor fabs. These advancements not only improve production capabilities but also reduce costs, making EUV lithography a more attractive option for manufacturers aiming to stay competitive in the rapidly evolving semiconductor landscape.

Growing Focus on Sustainability and Energy Efficiency

The Germany Extreme Ultraviolet Euv Lithography Market is increasingly influenced by a growing focus on sustainability and energy efficiency. As environmental concerns rise, semiconductor manufacturers are seeking ways to minimize their carbon footprint and energy consumption. EUV lithography, with its ability to produce smaller and more efficient chips, aligns well with these sustainability goals. In 2025, it was reported that EUV technology could reduce energy consumption in semiconductor manufacturing by up to 30%. This shift towards sustainable practices not only meets regulatory requirements but also appeals to environmentally conscious consumers. Consequently, the emphasis on sustainability is likely to drive further investments in EUV lithography technologies within Germany.

Rising Demand for Advanced Semiconductor Technologies

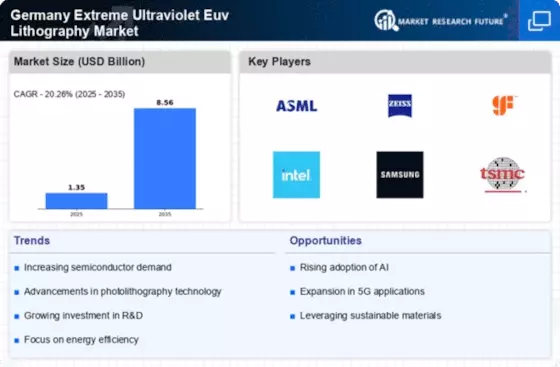

The Germany Extreme Ultraviolet Euv Lithography Market is experiencing a surge in demand for advanced semiconductor technologies. As the global market for electronics continues to expand, German manufacturers are increasingly adopting EUV lithography to produce smaller, more efficient chips. This technology enables the fabrication of devices with smaller nodes, which is essential for meeting the performance requirements of modern applications such as artificial intelligence and 5G communications. In 2025, the semiconductor market in Germany was valued at approximately 20 billion euros, with EUV lithography playing a crucial role in this growth. The increasing complexity of semiconductor designs necessitates the adoption of EUV technology, positioning Germany as a key player in the global semiconductor landscape.