Emergence of Quantum Startups

The enterprise quantum-computing market in China is witnessing the emergence of numerous startups focused on quantum technologies. These startups are often at the forefront of innovation, developing novel applications and solutions that cater to various industries. The vibrant startup ecosystem is supported by venture capital investments, with funding for quantum startups in China reaching approximately $1 billion in 2025. This influx of capital is enabling startups to accelerate their research and development efforts, contributing to the overall growth of the enterprise quantum-computing market. As these companies continue to innovate, they are likely to play a crucial role in shaping the future landscape of quantum computing in China.

Government Support and Funding

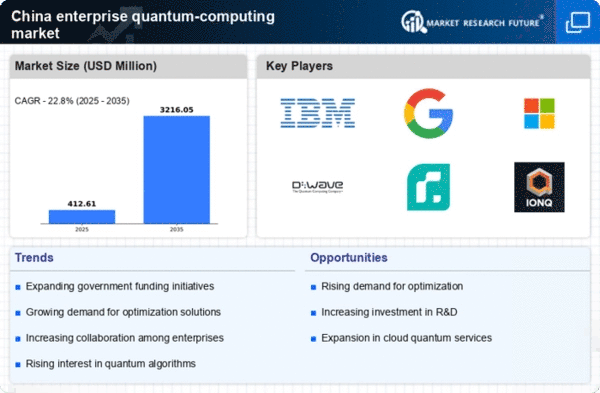

The enterprise quantum-computing market in China benefits from substantial government support and funding initiatives. The Chinese government has recognized the strategic importance of quantum technologies and has allocated significant resources to research and development. In 2021, the government announced a $10 billion investment plan aimed at advancing quantum computing capabilities. This funding is expected to enhance the infrastructure and talent pool necessary for the growth of the enterprise quantum-computing market. Furthermore, various national programs and policies are being implemented to foster innovation and collaboration among academic institutions and private enterprises. This supportive environment is likely to accelerate advancements in quantum technologies, making them more accessible to businesses across multiple sectors.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are pivotal in shaping the enterprise quantum-computing market in China. Companies are increasingly recognizing the need to pool resources and expertise to accelerate the development of quantum technologies. Collaborations between tech giants, startups, and academic institutions are fostering innovation and driving research efforts. For example, partnerships between leading universities and technology firms have led to breakthroughs in quantum algorithms and hardware development. These alliances not only enhance the capabilities of the enterprise quantum-computing market but also facilitate knowledge transfer and skill development, which are essential for sustaining growth in this rapidly evolving field.

Rising Interest in Quantum Security Solutions

As cyber threats become more sophisticated, the enterprise quantum-computing market in China is witnessing a rising interest in quantum security solutions. Quantum computing has the potential to revolutionize cybersecurity by providing unprecedented levels of encryption and data protection. Organizations are increasingly aware of the vulnerabilities associated with classical encryption methods, prompting them to explore quantum-resistant algorithms. The Chinese government has also emphasized the importance of quantum security in its national strategy, leading to increased investments in research and development. This focus on security solutions is likely to drive growth in the enterprise quantum-computing market, as businesses seek to safeguard their data against emerging threats.

Growing Demand for Advanced Computing Solutions

The enterprise quantum-computing market in China is experiencing a surge in demand for advanced computing solutions. As industries increasingly seek to solve complex problems that traditional computing cannot efficiently address, quantum computing emerges as a viable alternative. For instance, sectors such as finance, pharmaceuticals, and logistics are exploring quantum algorithms to optimize operations and enhance decision-making processes. According to recent estimates, the demand for quantum computing services in China is projected to grow at a CAGR of 30% from 2025 to 2030. This growing interest indicates a shift towards adopting quantum technologies, which could revolutionize how enterprises approach data analysis and problem-solving.