Rising Healthcare Expenditure

The upward trend in healthcare expenditure in China is a crucial driver for the electrophysiology market. With the government and private sectors increasing their investments in healthcare, the overall spending is projected to reach $1 trillion by 2025. This increase in expenditure is likely to facilitate the adoption of advanced electrophysiology technologies and treatments, as healthcare providers seek to improve patient care and outcomes. Moreover, as patients become more willing to invest in their health, the demand for specialized electrophysiology services is expected to rise. This trend indicates a robust growth trajectory for the electrophysiology market, as stakeholders respond to the evolving needs of the healthcare landscape.

Growing Awareness and Education

The increasing awareness and education regarding cardiac health among the Chinese population is a vital driver for the electrophysiology market. Public health campaigns and educational initiatives are effectively informing individuals about the risks associated with cardiac diseases and the importance of early detection and treatment. As a result, more patients are seeking electrophysiology services, leading to a higher demand for diagnostic and therapeutic procedures. In 2025, it is estimated that the number of electrophysiology procedures performed in China will increase by approximately 15%. This heightened awareness is likely to foster a more proactive approach to cardiac health, thereby propelling the growth of the electrophysiology market.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure are significantly influencing the electrophysiology market in China. The Chinese government has been actively investing in healthcare reforms, which include increasing funding for cardiac care and research. In 2025, it is estimated that healthcare spending will account for approximately 7% of the GDP, with a substantial portion allocated to cardiovascular health. These initiatives not only enhance access to electrophysiology services but also encourage the development of new technologies and treatment protocols. As a result, the electrophysiology market is likely to benefit from increased research funding and support for innovative solutions that address the growing burden of cardiac diseases.

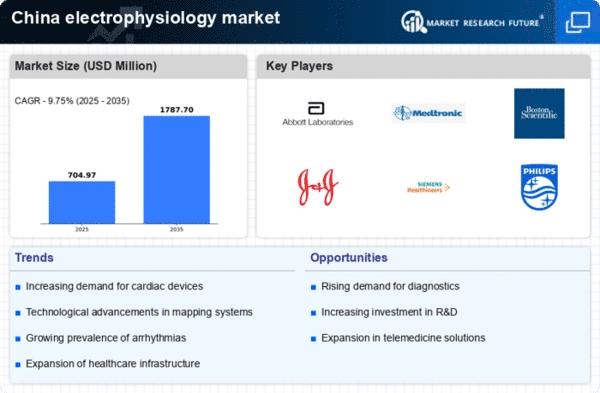

Increasing Demand for Cardiac Devices

The rising demand for advanced cardiac devices is a pivotal driver for the electrophysiology market in China. As the population ages, the prevalence of cardiac diseases is expected to increase, leading to a greater need for effective treatment options. In 2025, the market for cardiac devices is projected to reach approximately $10 billion, reflecting a compound annual growth rate (CAGR) of around 8%. This surge in demand is likely to stimulate innovation and investment in the electrophysiology market, as manufacturers strive to develop cutting-edge technologies that enhance patient outcomes. Furthermore, the growing awareness of heart health among the Chinese population is expected to drive the adoption of these devices, thereby contributing to the overall growth of the market.

Technological Integration in Healthcare

The integration of advanced technologies into healthcare practices is transforming the electrophysiology market in China. Innovations such as artificial intelligence (AI), machine learning, and telemedicine are being increasingly adopted in cardiac care. These technologies enhance diagnostic accuracy and treatment efficacy, thereby improving patient outcomes. In 2025, it is anticipated that the market for AI in healthcare will exceed $2 billion, with a significant portion directed towards electrophysiology applications. This technological integration not only streamlines workflows but also enables healthcare providers to offer more personalized care. Consequently, the electrophysiology market is likely to experience accelerated growth as these technologies become more prevalent in clinical settings.