Expansion of Drone Delivery Services

The expansion of drone delivery services is emerging as a pivotal driver in the China drones market. E-commerce giants and logistics companies are increasingly exploring drone technology to enhance delivery efficiency and reduce operational costs. The Chinese government has been supportive of these initiatives, providing regulatory frameworks that facilitate the testing and deployment of drone delivery systems. As of January 2026, several pilot programs are underway in urban areas, with companies reporting delivery times reduced by up to 50% compared to traditional methods. This trend indicates a shift in consumer expectations and a growing acceptance of drone technology in everyday life, which could significantly reshape the logistics landscape in China.

Increased Applications in Various Sectors

The versatility of drones is propelling their adoption across multiple sectors within the China drones market. Industries such as agriculture, logistics, and public safety are increasingly leveraging drone technology for enhanced efficiency and cost-effectiveness. For example, in agriculture, drones are utilized for precision farming, enabling farmers to monitor crop health and optimize resource usage. In logistics, companies are exploring drone delivery systems to streamline operations and reduce delivery times. Market data indicates that the agricultural drone segment alone is expected to reach a valuation of USD 2 billion by 2027. This trend suggests a growing recognition of the potential benefits that drones can offer across diverse applications.

Regulatory Developments and Government Support

The regulatory framework governing the China drones market is evolving, with the government actively promoting the integration of drones into various sectors. Recent policies have streamlined the approval process for drone operations, facilitating easier access for businesses and individuals. The Civil Aviation Administration of China (CAAC) has implemented guidelines that encourage the use of drones for commercial purposes, particularly in agriculture and infrastructure inspection. This supportive regulatory environment is expected to drive market growth, as it not only enhances safety but also fosters innovation. As of January 2026, the number of registered commercial drones in China has surpassed 500,000, reflecting the positive impact of these regulatory changes on the industry.

Technological Advancements in Drone Manufacturing

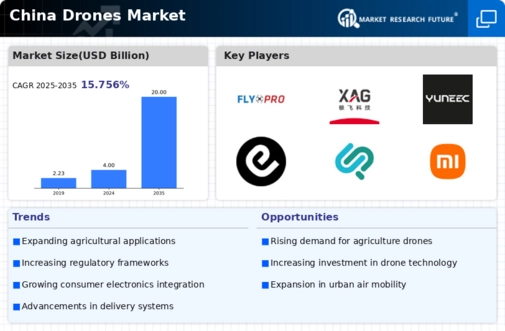

The China drones market is experiencing rapid technological advancements that are reshaping the landscape of drone manufacturing. Innovations in battery technology, materials science, and artificial intelligence are enhancing the performance and capabilities of drones. For instance, the introduction of lightweight composite materials has improved flight efficiency, while AI-driven navigation systems are enabling autonomous operations. According to recent data, the market for drone components in China is projected to grow at a compound annual growth rate of 15% through 2028. This growth is indicative of the increasing investment in research and development, which is likely to yield more sophisticated drones tailored for various applications, including agriculture, surveillance, and logistics.

Growing Demand for Surveillance and Security Solutions

The demand for surveillance and security solutions is a significant driver in the China drones market. With increasing concerns over public safety and security, both governmental and private entities are investing in drone technology for monitoring and surveillance purposes. Drones equipped with high-resolution cameras and advanced sensors are being deployed for urban surveillance, border control, and disaster management. Recent statistics indicate that the market for security drones in China is projected to grow by 20% annually, reflecting the heightened focus on safety and security measures. This growing demand is likely to spur further innovation and development within the industry, as companies strive to meet the evolving needs of security applications.