Increased Focus on Data Security

Data security has emerged as a critical concern for consumers and businesses in the China digital storage devices market. With the rise in cyber threats and data breaches, there is a growing emphasis on secure storage solutions that protect sensitive information. In response, manufacturers are integrating advanced encryption technologies and security features into their storage devices. The Chinese government has implemented stringent regulations to ensure data protection. This has further driven the demand for secure storage solutions. In 2025, the market for secure digital storage devices in China was estimated to be worth around 8 billion USD, reflecting a heightened awareness of data security among consumers. This focus on security is likely to shape product development and marketing strategies within the China digital storage devices market, as companies strive to meet the evolving needs of their customers.

Advancements in Storage Technology

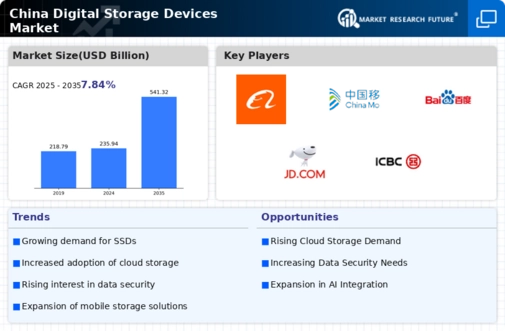

Technological advancements play a pivotal role in shaping the China digital storage devices market. Innovations such as 3D NAND technology and the development of NVMe interfaces have significantly improved the performance and efficiency of storage devices. These advancements enable faster data transfer rates and increased durability, which are crucial for both consumer and enterprise applications. In 2025, the market share of SSDs in China reached 40%, indicating a strong preference for these high-performance storage solutions. As manufacturers continue to invest in research and development, the introduction of next-generation storage technologies is anticipated to further enhance the capabilities of digital storage devices. This ongoing evolution in technology is likely to attract more consumers and businesses, thereby driving growth within the China digital storage devices market.

Rising Adoption of Cloud Computing

The increasing adoption of cloud computing services is significantly influencing the China digital storage devices market. As organizations transition to cloud-based solutions for data management and storage, the demand for compatible digital storage devices is expected to rise. In 2025, the cloud storage market in China was valued at over 10 billion USD, showcasing a growing trend towards cloud integration. This shift not only enhances data accessibility but also necessitates the use of reliable storage devices that can seamlessly interface with cloud platforms. Consequently, manufacturers are likely to focus on developing storage solutions that cater to this trend, thereby fostering innovation and competition within the China digital storage devices market. The synergy between cloud services and digital storage devices is poised to create new opportunities for growth and expansion.

Government Initiatives and Policies

Government initiatives and policies are playing a crucial role in shaping the China digital storage devices market. The Chinese government has launched various programs aimed at promoting technological innovation and digital infrastructure development. These initiatives are designed to enhance the competitiveness of the domestic storage device manufacturing sector. For instance, the 'Made in China 2025' strategy emphasizes the importance of advanced manufacturing technologies, including digital storage solutions. As a result, investments in research and development are expected to increase, leading to the introduction of more sophisticated storage devices. Furthermore, supportive policies are likely to encourage collaboration between industry players and research institutions, fostering a conducive environment for innovation. This proactive approach by the government is anticipated to drive growth and transformation within the China digital storage devices market.

Growing Demand for High-Capacity Storage Solutions

The China digital storage devices market is experiencing a notable surge in demand for high-capacity storage solutions. As data generation continues to escalate, driven by the proliferation of digital content and the Internet of Things (IoT), consumers and businesses alike are seeking storage devices that can accommodate vast amounts of information. In 2025, the market for external hard drives and SSDs in China reached approximately 15 billion USD, reflecting a robust growth trajectory. This trend is likely to persist as enterprises increasingly rely on data analytics and cloud computing, necessitating advanced storage solutions. Furthermore, the Chinese government's initiatives to promote digital transformation across various sectors are expected to further bolster the demand for high-capacity storage devices, thereby enhancing the overall landscape of the China digital storage devices market.