Growing Geriatric Population

China's demographic shift towards an older population is significantly influencing the compression therapy market. By 2025, it is projected that over 300 million individuals will be aged 60 and above, a demographic that is particularly susceptible to conditions requiring compression therapy. The elderly often experience reduced mobility and increased risk of venous disorders, necessitating the use of compression garments and devices. This demographic trend suggests a sustained demand for compression therapy solutions tailored to the needs of older adults, thereby driving market growth. Furthermore, healthcare systems are adapting to provide better access to these therapies, enhancing their availability and affordability.

Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases in China, such as diabetes and cardiovascular disorders, is a notable driver for the compression therapy market. As these conditions often lead to complications like venous insufficiency and lymphedema, the demand for effective treatment options is surging. Reports indicate that approximately 11.6% of the adult population in China suffers from diabetes, which can exacerbate circulatory issues. Consequently, healthcare providers are increasingly recommending compression therapy as a viable solution. This trend is likely to continue, as the aging population further contributes to the rise in chronic health issues, thereby expanding the market for compression therapy products.

Rising Awareness of Preventive Healthcare

There is a growing trend in China towards preventive healthcare, which is positively impacting the compression therapy market. As individuals become more health-conscious, they are increasingly seeking ways to prevent conditions that necessitate therapeutic interventions. Compression therapy is often recommended for its preventive benefits, particularly in managing venous health and improving circulation. This shift in mindset is likely to lead to a broader acceptance of compression products among the general population. Market analysts suggest that this trend could result in a 15% increase in the adoption of compression therapy solutions over the next few years, as more consumers recognize the importance of proactive health management.

Increased Investment in Healthcare Infrastructure

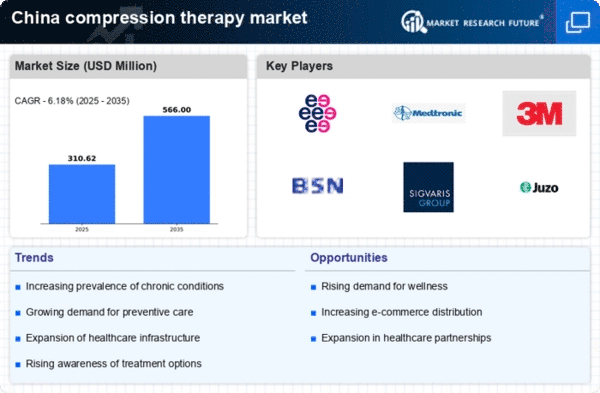

China's government is actively investing in healthcare infrastructure, which is likely to bolster the compression therapy market. The National Health Commission has outlined plans to enhance healthcare services, including the provision of advanced medical devices and therapies. This investment is expected to improve access to compression therapy products across various healthcare settings, from hospitals to outpatient clinics. As a result, the market is anticipated to expand, with an estimated growth rate of 8.5% annually over the next five years. Enhanced healthcare facilities will facilitate better patient education and awareness regarding the benefits of compression therapy, further driving market demand.

Technological Innovations in Compression Products

The compression therapy market is experiencing a wave of technological innovations that are enhancing product efficacy and user experience. Advances in materials and design are leading to the development of more comfortable and effective compression garments. For instance, the introduction of smart textiles that monitor physiological parameters is gaining traction. These innovations not only improve the therapeutic outcomes but also attract a tech-savvy consumer base. As the market evolves, it is expected that these technological advancements will contribute to a projected market growth of 10% annually, as consumers increasingly seek out high-quality, innovative compression therapy solutions.