Government Initiatives and Support

The cloud storage market in China benefits significantly from government initiatives aimed at promoting digital transformation. The Chinese government has implemented various policies to encourage the adoption of cloud technologies across industries. For instance, the '14th Five-Year Plan' emphasizes the importance of cloud computing in enhancing productivity and innovation. This support is reflected in increased funding for cloud infrastructure projects, which is expected to reach approximately $30 billion by 2026. Such initiatives not only bolster the cloud storage market but also create a conducive environment for businesses to transition to cloud-based solutions, thereby driving market growth.

Rising Demand for Scalable Solutions

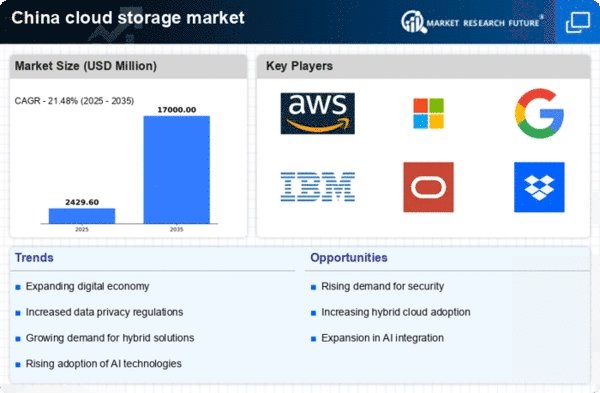

The cloud storage market in China experiences a notable surge in demand for scalable solutions. As businesses expand, they require storage options that can grow alongside their operations. This trend is particularly evident in sectors such as e-commerce and technology, where data generation is substantial. According to recent data, the market is projected to grow at a CAGR of approximately 25% over the next five years. Companies are increasingly seeking flexible storage solutions that can accommodate fluctuating data needs without incurring excessive costs. This rising demand for scalability is a key driver in the cloud storage market, as organizations prioritize efficiency and adaptability in their data management strategies.

Growing Data Generation and Consumption

The cloud storage market in China is propelled by the exponential growth in data generation and consumption. With the rise of IoT devices, social media, and digital content creation, the volume of data produced is staggering. Reports indicate that data generation in China is expected to reach 48 zettabytes by 2025. This surge necessitates robust cloud storage solutions to manage and store vast amounts of information efficiently. As organizations seek to harness the value of big data, the demand for cloud storage services continues to escalate, positioning this market as a critical component of the broader digital economy.

Increased Focus on Disaster Recovery Solutions

In the cloud storage market, there is an increasing emphasis on disaster recovery solutions. Businesses in China are becoming more aware of the risks associated with data loss due to cyberattacks, natural disasters, or system failures. Consequently, organizations are investing in cloud storage solutions that offer reliable backup and recovery options. The market for disaster recovery as a service (DRaaS) is projected to grow significantly, with estimates suggesting a CAGR of around 20% over the next few years. This focus on disaster recovery not only enhances data security but also reinforces the overall resilience of businesses, making it a vital driver in the cloud storage market.

Shift Towards Remote Work and Collaboration Tools

The cloud storage market in China is experiencing a transformative shift towards remote work and collaboration tools. As organizations adapt to new work environments, the need for accessible and secure data storage solutions has intensified. Cloud storage enables seamless collaboration among remote teams, facilitating real-time access to files and documents. This trend is underscored by a reported increase in the adoption of cloud-based collaboration platforms, which has risen by approximately 40% in the past year. The shift towards remote work not only drives demand for cloud storage but also reshapes how businesses approach data management and collaboration, positioning the market for sustained growth.