Growing Awareness of Oral Health

The growing awareness of oral health among the Chinese population is significantly impacting the CBCT dental market. Public health campaigns and educational initiatives have led to an increased understanding of the importance of regular dental check-ups and advanced diagnostic tools. As individuals become more proactive about their oral health, the demand for comprehensive dental services, including those utilizing CBCT technology, is likely to rise. Market Research Future suggests that the awareness of advanced imaging benefits is contributing to a shift in patient preferences towards clinics that offer state-of-the-art diagnostic capabilities. This trend is expected to drive the growth of the China CBCT dental market, as practitioners adapt to meet the evolving needs of informed patients seeking high-quality dental care.

Regulatory Changes and Compliance

Regulatory changes in China are significantly influencing the CBCT dental market. The government has implemented stricter guidelines regarding the use of imaging technologies in dental practices, emphasizing patient safety and data protection. Compliance with these regulations is essential for manufacturers and practitioners alike, as non-compliance could lead to penalties or loss of licensure. As of January 2026, the Chinese government continues to promote the use of advanced imaging technologies while ensuring that they meet safety standards. This regulatory environment is fostering innovation among manufacturers, who are now focusing on developing compliant and efficient CBCT systems. Consequently, the regulatory landscape is shaping the future of the China CBCT dental market, encouraging growth while prioritizing patient welfare.

Rising Demand for Cosmetic Dentistry

The increasing demand for cosmetic dentistry in China is a pivotal driver for the CBCT dental market. As more individuals seek aesthetic dental procedures, the need for precise imaging becomes paramount. CBCT technology provides detailed three-dimensional images that are essential for planning complex cosmetic procedures, such as dental implants and orthodontics. Market data indicates that the cosmetic dentistry segment is expected to grow by over 20% in the next five years, further fueling the demand for CBCT systems. This trend reflects a broader societal shift towards prioritizing dental aesthetics, which is likely to sustain the growth of the China CBCT dental market. As practitioners invest in advanced imaging technologies, they enhance their ability to meet patient expectations and improve treatment outcomes.

Technological Advancements in Imaging

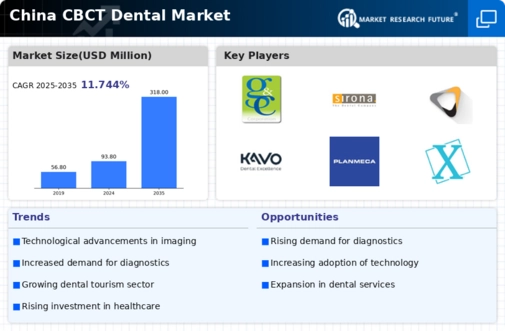

The China CBCT dental market is experiencing rapid growth due to technological advancements in imaging techniques. Innovations in cone beam computed tomography (CBCT) have led to enhanced image quality, reduced radiation exposure, and improved diagnostic capabilities. The integration of artificial intelligence in imaging software is also streamlining workflows and increasing accuracy in treatment planning. As of January 2026, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years, driven by these advancements. Furthermore, the increasing adoption of digital dentistry is likely to further propel the demand for CBCT systems, as practitioners seek to provide more precise and efficient care. This trend indicates a robust future for the China CBCT dental market.

Increased Investment in Dental Infrastructure

Investment in dental infrastructure across China is a crucial driver for the CBCT dental market. The government has recognized the importance of oral health and is allocating resources to improve dental facilities, particularly in underserved areas. As of January 2026, numerous initiatives are underway to enhance dental care accessibility, which includes the procurement of advanced imaging technologies like CBCT systems. This investment is expected to lead to a proliferation of dental clinics equipped with state-of-the-art technology, thereby increasing the demand for CBCT systems. Furthermore, private sector investments are also on the rise, as dental practitioners seek to modernize their practices. This trend indicates a promising outlook for the China CBCT dental market, as enhanced infrastructure will likely facilitate greater adoption of advanced imaging solutions.