Growth of Industrial Automation

The capacitor market is witnessing growth driven by the increasing adoption of industrial automation in China. As industries seek to enhance productivity and efficiency, the demand for capacitors in automation systems is on the rise. Capacitors are vital for power supply stabilization and energy efficiency in automated machinery. The industrial automation sector is expected to grow at a CAGR of around 10% through 2025, indicating a robust demand for capacitors. This growth presents opportunities for manufacturers to innovate and provide tailored solutions that meet the specific requirements of automated systems, thereby strengthening their position in the capacitor market.

Surge in Renewable Energy Projects

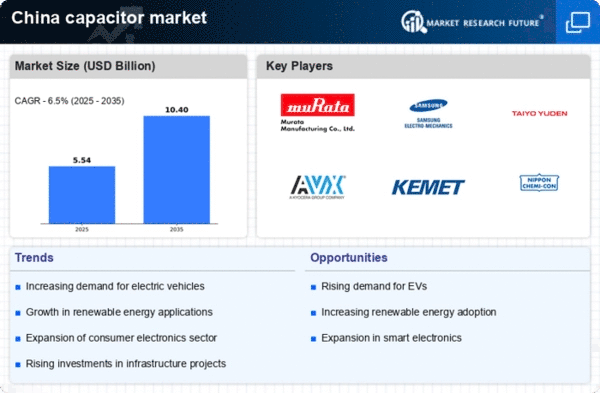

The capacitor market in China is experiencing a notable surge due to the increasing investment in renewable energy projects. As the country aims to enhance its energy mix, the demand for capacitors in solar and wind energy applications is rising. Capacitors play a crucial role in energy storage systems, helping to stabilize power supply and improve efficiency. In 2025, the renewable energy sector is projected to account for approximately 30% of China's total energy consumption, driving the need for advanced capacitor technologies. This trend indicates a robust growth trajectory for the capacitor market, as manufacturers adapt to meet the specific requirements of renewable energy applications.

Rising Focus on Energy Efficiency Standards

The capacitor market in China is influenced by the rising focus on energy efficiency standards across various sectors. The government is implementing stricter regulations aimed at reducing energy consumption and promoting sustainable practices. Capacitors are essential in achieving these energy efficiency goals, as they help optimize power usage in electrical systems. By 2025, it is anticipated that energy efficiency regulations will become more stringent, leading to increased demand for high-performance capacitors. This trend indicates that manufacturers in the capacitor market must prioritize the development of energy-efficient solutions to comply with regulations and meet market expectations.

Expansion of Electric Vehicle Infrastructure

The rapid expansion of electric vehicle (EV) infrastructure in China is significantly impacting the capacitor market. With the government promoting EV adoption through incentives and subsidies, the demand for capacitors in charging stations and battery management systems is increasing. Capacitors are essential for managing power flow and ensuring the efficiency of EV charging systems. By 2025, it is estimated that the number of EV charging stations in China will exceed 1 million, creating a substantial market for capacitors. This growth in the EV sector is likely to drive innovation and competition within the capacitor market, as manufacturers seek to develop high-performance solutions tailored for this burgeoning industry.

Technological Innovations in Consumer Electronics

The capacitor market in China is being propelled by technological innovations in consumer electronics. As the demand for smart devices, such as smartphones, tablets, and wearables, continues to rise, the need for compact and efficient capacitors is becoming increasingly critical. Capacitors are integral components in these devices, providing power stability and enhancing performance. In 2025, the consumer electronics sector is projected to grow by approximately 15%, further driving the demand for capacitors. This trend suggests that manufacturers in the capacitor market must focus on developing advanced materials and designs to meet the evolving needs of the consumer electronics industry.