Growth in Consumer Electronics

The increasing demand for consumer electronics in Mexico is a pivotal driver for the capacitor market. As households and businesses adopt advanced electronic devices, the need for capacitors, which are essential components in these devices, rises. The consumer electronics sector is projected to grow at a CAGR of approximately 8% from 2025 to 2030. This growth is likely to stimulate the capacitor market, as manufacturers seek to meet the rising demand for efficient and reliable electronic components. Furthermore, the shift towards smart devices and IoT applications necessitates the use of high-performance capacitors, thereby enhancing the market's potential. The capacitor market in Mexico is expected to benefit significantly from this trend, as local manufacturers adapt to the evolving needs of the electronics industry.

Increased Focus on Energy Efficiency

The heightened focus on energy efficiency in Mexico is driving the capacitor market. As businesses and consumers become more aware of energy consumption and its environmental impact, there is a growing demand for energy-efficient solutions. Capacitors are integral to energy-saving technologies, such as power factor correction and energy storage systems. The Mexican government has implemented regulations aimed at promoting energy efficiency, which could lead to increased adoption of capacitors in various sectors. This regulatory environment is likely to encourage manufacturers to innovate and develop capacitors that meet stringent energy efficiency standards. Consequently, the capacitor market is poised for growth as it aligns with the broader trend of sustainability and energy conservation.

Infrastructure Development Initiatives

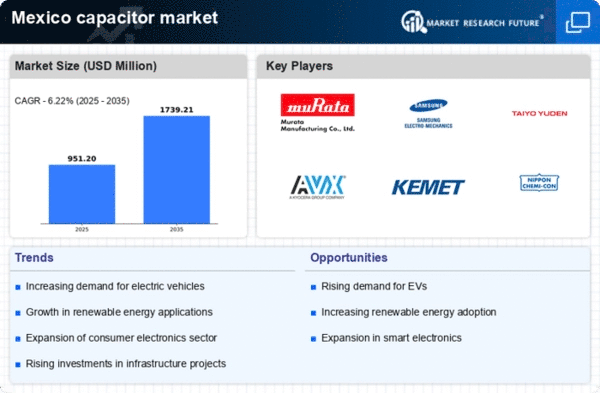

Mexico's ongoing infrastructure development initiatives are likely to bolster the capacitor market. The government has prioritized investments in transportation, energy, and telecommunications infrastructure, which inherently require capacitors for various applications. For instance, capacitors are crucial in power distribution systems and renewable energy projects, such as solar and wind farms. The Mexican government has allocated approximately $10 billion for infrastructure projects in 2025, which could lead to increased demand for capacitors. This investment is expected to create opportunities for manufacturers and suppliers within the capacitor market, as they cater to the needs of these large-scale projects. The growth in infrastructure is anticipated to drive innovation and efficiency in capacitor technology, further enhancing the market landscape.

Technological Innovations in Manufacturing

Technological innovations in manufacturing processes are transforming the capacitor market in Mexico. Advances in materials science and production techniques are enabling manufacturers to produce capacitors that are smaller, more efficient, and more reliable. This trend is particularly relevant as the demand for compact and high-performance electronic components continues to grow. The introduction of automated manufacturing processes is also likely to reduce production costs, making capacitors more accessible to a broader range of applications. As companies invest in research and development, the capacitor market is expected to witness a wave of new products that cater to the evolving needs of various industries, including automotive, telecommunications, and consumer electronics.

Rising Adoption of Renewable Energy Solutions

The shift towards renewable energy solutions in Mexico is a significant driver for the capacitor market. As the country aims to increase its renewable energy capacity, particularly in solar and wind energy, the demand for capacitors is expected to rise. Capacitors play a vital role in energy storage systems and power conditioning, which are essential for integrating renewable sources into the grid. The Mexican government has set a target of generating 35% of its energy from renewable sources by 2024, which may lead to a surge in capacitor installations. This transition not only supports environmental goals but also stimulates the capacitor market, as manufacturers innovate to provide solutions that meet the specific requirements of renewable energy applications.