Growing Automotive Sector

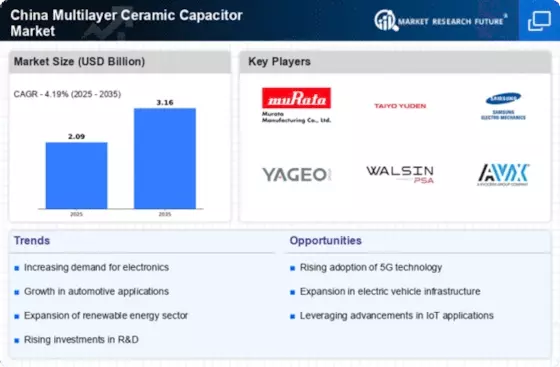

The automotive sector in China is experiencing rapid growth, which significantly influences the China Multilayer Ceramic Capacitor Market. With the increasing production of vehicles, particularly electric vehicles (EVs), the demand for multilayer ceramic capacitors is expected to rise. These capacitors are essential for various automotive applications, including power management and signal processing. In 2025, the automotive industry in China was projected to reach a market size of approximately 4 trillion yuan, indicating a robust demand for electronic components. As automakers continue to innovate and integrate advanced technologies, the reliance on multilayer ceramic capacitors is likely to increase, thereby driving the market forward.

Increased Focus on Renewable Energy

The shift towards renewable energy sources in China is likely to impact the China Multilayer Ceramic Capacitor Market positively. As the country aims to achieve carbon neutrality by 2060, investments in solar and wind energy are surging. In 2025, the renewable energy sector was estimated to contribute over 30% to China's total energy consumption. Multilayer ceramic capacitors are essential in energy storage systems and power conversion applications, making them vital components in renewable energy technologies. This growing emphasis on sustainable energy solutions may drive demand for multilayer ceramic capacitors, as manufacturers seek to enhance the efficiency and reliability of their products.

Technological Advancements in Electronics

Technological advancements in the electronics sector are significantly influencing the China Multilayer Ceramic Capacitor Market. The continuous evolution of consumer electronics, including smartphones, tablets, and wearables, has led to an increased demand for compact and efficient electronic components. In 2025, the consumer electronics market in China was valued at approximately 1.5 trillion yuan, indicating a robust growth trajectory. Multilayer ceramic capacitors are favored for their small size and high capacitance, making them ideal for modern electronic devices. As manufacturers strive to meet consumer demands for high-performance products, the reliance on advanced capacitors is expected to grow, thereby propelling the market.

Expansion of Telecommunications Infrastructure

China's telecommunications infrastructure is undergoing significant expansion, which is likely to bolster the China Multilayer Ceramic Capacitor Market. The government has been investing heavily in 5G technology, aiming to enhance connectivity and communication capabilities across the nation. As of early 2026, China has deployed over 1 million 5G base stations, creating a substantial demand for electronic components, including multilayer ceramic capacitors. These capacitors play a crucial role in ensuring the reliability and efficiency of telecommunications equipment. The ongoing development of smart cities and IoT applications further emphasizes the need for advanced capacitors, suggesting a promising outlook for the market.

Government Policies Supporting Electronics Manufacturing

Government policies in China aimed at supporting the electronics manufacturing sector are likely to have a positive impact on the China Multilayer Ceramic Capacitor Market. Initiatives such as the Made in China 2025 plan emphasize the importance of developing advanced manufacturing capabilities and promoting innovation. These policies encourage domestic production of electronic components, including multilayer ceramic capacitors, reducing reliance on imports. As of early 2026, the government has implemented various incentives for manufacturers to enhance production efficiency and invest in research and development. This supportive regulatory environment may foster growth in the multilayer ceramic capacitor market, as companies seek to capitalize on these opportunities.