Government Support for Innovation

the blockchain fintech market is significantly influenced by government support for technological innovation. The Chinese government has implemented various policies to foster the development of blockchain technologies, recognizing their potential to enhance financial services. In 2025, the government allocated over $1 billion to blockchain research and development initiatives, aiming to position China as a leader in this sector. This financial backing encourages startups and established companies to explore blockchain applications in finance, thereby driving market growth. Furthermore, the establishment of blockchain innovation hubs across major cities facilitates collaboration between tech firms and financial institutions. Such initiatives not only stimulate the blockchain fintech market but also create a conducive environment for the emergence of new business models and services.

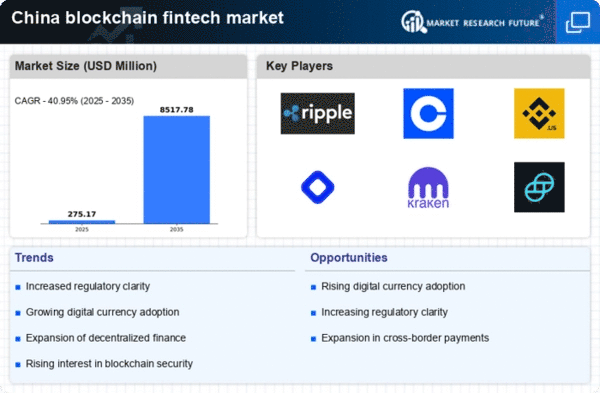

Surge in Digital Payment Adoption

the blockchain fintech market experiences a notable surge in digital payment adoption, driven by the increasing preference for cashless transactions. As of 2025, approximately 80% of consumers utilize mobile payment platforms, reflecting a shift towards convenience and efficiency. This trend is further supported by government initiatives promoting digital finance, which aim to enhance financial inclusion. The blockchain fintech market benefits from this shift, as blockchain technology provides secure and transparent transaction methods. Moreover, the integration of blockchain in payment systems reduces transaction costs and enhances speed, making it an attractive option for both consumers and businesses. The growing acceptance of digital currencies, including the digital yuan, further propels the blockchain fintech market, indicating a robust future for digital payment solutions in China.

Expansion of Cross-Border Transactions

the blockchain fintech market is poised for growth due to the expansion of cross-border transactions. As international trade continues to flourish, businesses are increasingly seeking efficient and cost-effective methods for conducting cross-border payments. Blockchain technology facilitates real-time transactions, significantly reducing the time and costs associated with traditional banking systems. In 2025, it is estimated that cross-border blockchain transactions could account for up to 30% of total transaction volume in the fintech sector. This trend is particularly relevant for Chinese companies looking to expand their global footprint. By leveraging blockchain, businesses can enhance their operational efficiency and reduce the risks associated with currency fluctuations. Consequently, the blockchain fintech market stands to benefit from the increasing demand for seamless cross-border financial solutions.

Emergence of Innovative Financial Products

the blockchain fintech market is witnessing the emergence of innovative financial products that cater to evolving consumer needs. As technology advances, financial institutions are leveraging blockchain to create new offerings, such as tokenized assets and decentralized lending platforms. These products not only enhance accessibility but also provide consumers with more options for investment and financing. In 2025, it is projected that the market for tokenized assets could reach $10 billion, reflecting a growing interest in alternative investment opportunities. Additionally, decentralized finance (DeFi) platforms are gaining traction, allowing users to engage in lending and borrowing without traditional intermediaries. This innovation is likely to reshape the financial landscape, driving further growth in the blockchain fintech market as consumers seek more flexible and diverse financial solutions.

Rising Demand for Transparency and Security

In the blockchain fintech market, there is a rising demand for transparency and security among consumers and businesses alike. As financial fraud and data breaches become increasingly prevalent, stakeholders are seeking solutions that enhance trust in financial transactions. Blockchain technology, with its decentralized and immutable nature, offers a compelling solution to these concerns. In 2025, surveys indicate that over 70% of consumers express a preference for financial services that utilize blockchain for enhanced security. This growing awareness drives financial institutions to adopt blockchain solutions, thereby expanding the market. Additionally, regulatory bodies are beginning to recognize the importance of transparency in financial operations, further encouraging the adoption of blockchain technology. As a result, the blockchain fintech market is likely to witness accelerated growth as organizations prioritize security and transparency in their operations.