Consumer Demand for Financial Inclusion

There is a growing consumer demand for financial inclusion, which is significantly influencing the Blockchain Fintech Market. Many Canadians, particularly those in underserved communities, are seeking alternative financial solutions that blockchain technology can provide. The ability to access financial services without traditional banking barriers is appealing, as it promotes economic empowerment. According to recent studies, approximately 20% of Canadians are unbanked or underbanked, highlighting a substantial market opportunity. Blockchain solutions can offer lower transaction costs and increased accessibility, making them attractive to this demographic. As awareness of these benefits spreads, the blockchain fintech market is likely to see increased adoption among consumers seeking inclusive financial services.

Technological Advancements in Blockchain

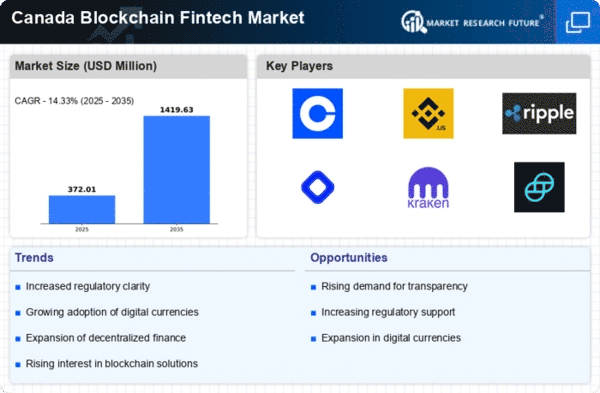

The Blockchain Fintech Market is experiencing rapid technological advancements that enhance transaction speed, security, and scalability. Innovations such as smart contracts and decentralized applications (dApps) are becoming increasingly prevalent. In Canada, the adoption of these technologies is projected to grow, with an estimated market size reaching $2 billion by 2026. This growth is driven by the need for more efficient financial services and the demand for transparency in transactions. As Canadian businesses and consumers become more aware of the benefits of blockchain technology, the market is likely to expand further. The integration of artificial intelligence and machine learning with blockchain solutions may also provide additional opportunities for innovation within the blockchain fintech market.

Growing Investment in Blockchain Startups

Investment in blockchain startups is surging, significantly impacting the Blockchain Fintech Market. In Canada, venture capital funding for blockchain-related companies has increased by over 50% in the past year, indicating a strong interest from investors. This influx of capital is likely to foster innovation and accelerate the development of new financial products and services. As more startups emerge, they contribute to a competitive landscape that drives advancements in technology and service offerings. The Canadian government has also shown support for blockchain initiatives, which may further encourage investment. This trend suggests that the blockchain fintech market will continue to evolve, attracting both domestic and international investors.

Regulatory Support for Blockchain Initiatives

Regulatory support for blockchain initiatives is emerging as a crucial driver for the Blockchain Fintech Market. In Canada, government agencies are actively exploring frameworks that promote the safe and responsible use of blockchain technology. This regulatory clarity is essential for fostering innovation and attracting investment. Recent initiatives, such as the Canadian Securities Administrators' guidelines on cryptocurrency offerings, indicate a willingness to embrace blockchain solutions while ensuring consumer protection. As regulations evolve, they may provide a more stable environment for businesses operating in the blockchain fintech market. This supportive regulatory landscape could encourage more companies to enter the market, further driving growth and development.

Collaboration Between Financial Institutions and Blockchain Firms

Collaboration between traditional financial institutions and blockchain firms is becoming increasingly prevalent, significantly impacting the Blockchain Fintech Market. In Canada, major banks are exploring partnerships with blockchain startups to enhance their service offerings and improve operational efficiency. These collaborations often focus on areas such as cross-border payments, identity verification, and fraud prevention. By leveraging blockchain technology, financial institutions can streamline processes and reduce costs. This trend suggests a shift towards a more integrated financial ecosystem, where traditional and innovative solutions coexist. As these partnerships grow, they are likely to drive further adoption of blockchain technology within the Canadian financial sector.