Growth of IoT Devices

The proliferation of Internet of Things (IoT) devices is driving the expansion of the big data market in China. With millions of devices generating vast amounts of data, organizations are increasingly seeking solutions to manage and analyze this information. In 2025, it is estimated that the number of connected IoT devices in China will surpass 1 billion, creating a substantial demand for big data analytics tools. This growth presents opportunities for businesses to leverage real-time data for improved decision-making and operational efficiency. Consequently, the big data market is likely to experience significant growth as companies invest in technologies that can harness the potential of IoT-generated data.

Emergence of 5G Technology

The rollout of 5G technology is poised to transform the big data market in China by enabling faster data transmission and enhanced connectivity. With 5G, the volume of data generated and transmitted will increase exponentially, necessitating advanced analytics and storage solutions. By 2025, it is projected that 5G networks will cover over 80% of urban areas in China, facilitating the growth of smart cities and connected devices. This technological advancement is likely to drive demand for big data solutions that can process and analyze large datasets in real-time, thereby propelling the big data market forward.

Increased Focus on Data Security

As data breaches and cyber threats become more prevalent, the emphasis on data security is a critical driver for the big data market in China. Organizations are investing heavily in security measures to protect sensitive information, which in turn fuels the demand for big data solutions that incorporate robust security features. In 2025, it is estimated that spending on data security solutions will reach $15 billion, reflecting a growth of approximately 30% annually. This heightened focus on security not only enhances consumer trust but also drives innovation within the big data market, as companies seek to develop secure and compliant data management practices.

Rising Demand for Data Analytics

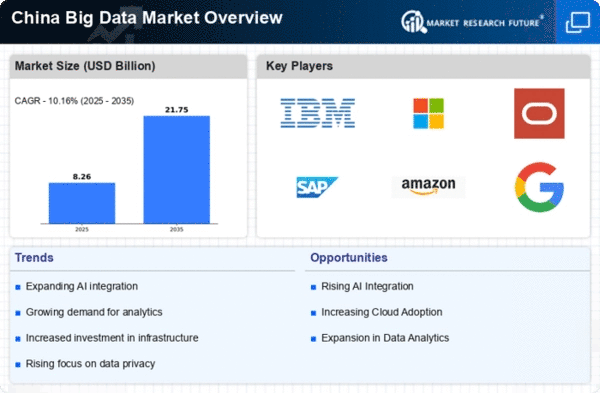

The increasing demand for data analytics in various sectors is a primary driver of the big data market in China. Organizations are recognizing the value of data-driven decision-making, leading to a surge in analytics tools and services. In 2025, the market for data analytics is projected to reach approximately $20 billion, reflecting a growth rate of around 25% annually. This trend is particularly evident in industries such as finance, healthcare, and retail, where insights derived from data analytics can enhance operational efficiency and customer engagement. As businesses strive to remain competitive, the integration of advanced analytics into their strategies is becoming essential, thereby propelling the growth of the big data market.

Government Initiatives and Support

Government initiatives aimed at promoting digital transformation are significantly influencing the big data market in China. The Chinese government has launched various programs to encourage the adoption of big data technologies across industries. For instance, the 'New Generation Artificial Intelligence Development Plan' emphasizes the importance of big data in enhancing national competitiveness. By 2025, it is anticipated that government investments in big data infrastructure will exceed $10 billion, fostering innovation and research in this field. Such support not only boosts the capabilities of local enterprises but also attracts foreign investments, thereby expanding the big data market in China.