Rising Demand for Targeted Therapies

The increasing prevalence of chronic diseases in China is driving the demand for targeted therapies, which rely heavily on data analytics. The big data-pharmaceutical-advertising market is experiencing growth as pharmaceutical companies seek to identify specific patient populations that would benefit from tailored treatments. This trend is supported by the fact that approximately 70% of healthcare expenditures in China are attributed to chronic diseases. Consequently, the need for precise data-driven marketing strategies is paramount, as companies aim to optimize their advertising efforts and improve patient outcomes. The integration of big data analytics allows for more effective targeting of advertisements, ensuring that the right messages reach the right audiences at the right time.

Regulatory Support for Data Utilization

The Chinese government is increasingly supportive of initiatives that promote the use of big data in the pharmaceutical sector. Recent regulatory frameworks aim to enhance data sharing and collaboration among stakeholders, which is crucial for the growth of the big data-pharmaceutical-advertising market. By establishing guidelines that facilitate data utilization while ensuring patient privacy, the government is fostering an environment conducive to innovation. This regulatory support is likely to encourage pharmaceutical companies to invest in data-driven advertising strategies, as they can leverage shared data to enhance their marketing efforts. The potential for improved patient outcomes through targeted advertising is a key motivator for this trend.

Increased Investment in Digital Marketing

The shift towards digital marketing strategies is becoming increasingly pronounced within the big data-pharmaceutical-advertising market. Pharmaceutical companies in China are allocating more resources to digital platforms, recognizing the potential for reaching a broader audience. In 2025, it is estimated that digital advertising spending in the pharmaceutical sector will account for over 50% of total marketing budgets. This transition is driven by the growing use of mobile devices and social media among healthcare professionals and patients. As a result, companies are utilizing big data to analyze consumer behavior and preferences, allowing for more targeted and effective advertising campaigns. This trend suggests a significant transformation in how pharmaceutical products are marketed in China.

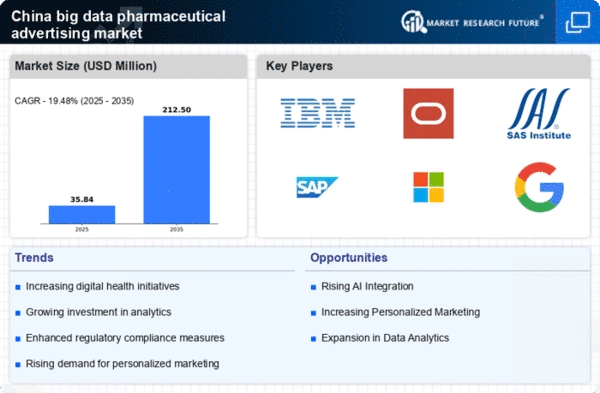

Advancements in Data Analytics Technologies

Technological advancements in data analytics are significantly impacting the big data-pharmaceutical-advertising market. The emergence of sophisticated analytics tools enables pharmaceutical companies to process vast amounts of data efficiently. In China, the market for big data analytics is projected to reach $30 billion by 2025, indicating a robust growth trajectory. These technologies facilitate the extraction of actionable insights from complex datasets, allowing for more informed decision-making in advertising strategies. As companies leverage these advancements, they can enhance their marketing campaigns, leading to improved engagement with healthcare professionals and patients alike. This evolution in data analytics is likely to reshape the landscape of pharmaceutical advertising in China.

Growing Emphasis on Patient-Centric Marketing

There is a notable shift towards patient-centric marketing strategies within the big data-pharmaceutical-advertising market. Pharmaceutical companies in China are increasingly focusing on understanding patient needs and preferences, which is essential for effective advertising. This approach is supported by the fact that 80% of patients express a desire for more personalized communication from healthcare providers. By utilizing big data analytics, companies can gain insights into patient behaviors and tailor their marketing messages accordingly. This trend not only enhances the relevance of advertising but also fosters stronger relationships between pharmaceutical companies and patients. As the market evolves, the emphasis on patient-centric strategies is likely to become a defining characteristic of pharmaceutical advertising in China.