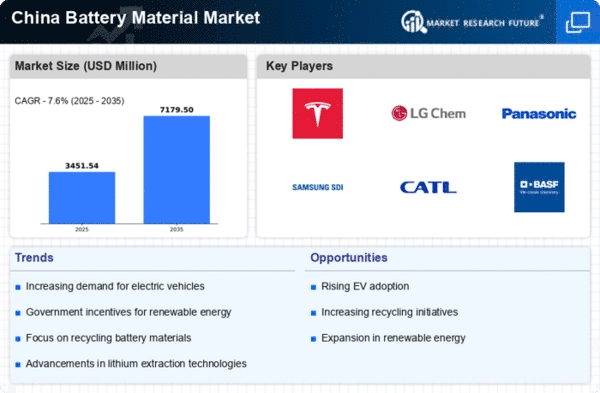

The battery material market in China is characterized by intense competition and rapid innovation, driven by the increasing demand for electric vehicles (EVs) and renewable energy storage solutions. Key players such as Contemporary Amperex Technology Co. Limited (China), LG Chem (Korea), and Tesla (US) are at the forefront, each adopting distinct strategies to enhance their market positions. Contemporary Amperex Technology Co. Limited (CATL) focuses on vertical integration, controlling the supply chain from raw materials to battery production, which allows for cost efficiencies and quality control. Meanwhile, LG Chem emphasizes innovation in battery chemistry, aiming to improve energy density and reduce charging times, thereby enhancing the performance of EVs. Tesla (US) continues to push the envelope with its Gigafactory model, which not only scales production but also integrates advanced manufacturing technologies to streamline operations.The competitive structure of the market appears moderately fragmented, with several players vying for market share. Key tactics such as localizing manufacturing and optimizing supply chains are prevalent among these companies. For instance, CATL has been expanding its production facilities within China to meet domestic demand, while LG Chem has been optimizing its supply chain to mitigate risks associated with raw material sourcing. This collective approach among major players indicates a trend towards greater resilience and adaptability in the face of market fluctuations.

In October Tesla (US) announced a partnership with a leading lithium supplier to secure long-term access to critical raw materials. This strategic move is likely to bolster Tesla's supply chain reliability, ensuring that it can meet the growing demand for its EVs without interruption. The partnership underscores the importance of securing raw materials in a market where supply constraints can significantly impact production capabilities.

In September LG Chem (Korea) unveiled a new battery technology that reportedly increases energy density by 20%, a substantial leap that could enhance the range of EVs. This innovation not only positions LG Chem as a leader in battery technology but also reflects the company's commitment to sustainability, as higher energy density can lead to reduced material usage and lower environmental impact. Such advancements are crucial in a market increasingly focused on eco-friendly solutions.

In August Contemporary Amperex Technology Co. Limited (China) expanded its production capacity by 30% through the establishment of a new facility in Jiangsu province. This expansion is indicative of CATL's aggressive growth strategy and its aim to solidify its position as a dominant player in the battery material market. The increased capacity is expected to cater to both domestic and international demand, further enhancing CATL's competitive edge.

As of November the competitive landscape is increasingly shaped by trends such as digitalization, sustainability, and the integration of artificial intelligence (AI) in manufacturing processes. Strategic alliances are becoming more common, as companies recognize the need to collaborate to enhance innovation and efficiency. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and adapt to changing market dynamics.