Rising Energy Demand

The advanced energy-storage-systems market in China is experiencing a surge in demand driven by the country's rapid industrialization and urbanization. As the population grows and living standards improve, energy consumption is projected to increase significantly. According to recent estimates, China's energy demand could rise by approximately 3.5% annually over the next decade. This escalating demand necessitates the integration of advanced energy-storage systems to ensure a stable and reliable energy supply. The ability of these systems to store excess energy generated from renewable sources, such as solar and wind, is crucial for meeting peak demand periods. Consequently, the advanced energy-storage-systems market is positioned to play a pivotal role in addressing the challenges posed by rising energy consumption in China.

Government Initiatives and Investments

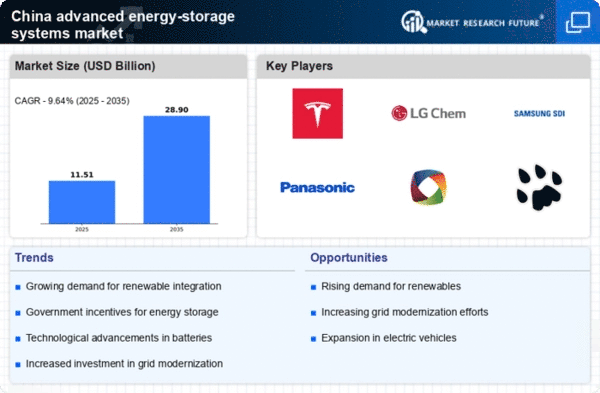

The Chinese government is actively promoting the development of the advanced energy-storage-systems market through various initiatives and substantial investments. In recent years, the government has allocated billions of dollars to support research and development in energy storage technologies. This includes funding for innovative projects aimed at enhancing battery efficiency and reducing costs. Furthermore, the government's commitment to achieving carbon neutrality by 2060 has led to the implementation of policies that encourage the adoption of renewable energy sources, which in turn drives the need for advanced energy-storage systems. As a result, the market is likely to witness accelerated growth, with projections indicating a compound annual growth rate (CAGR) of around 20% over the next five years.

Integration of Renewable Energy Sources

The transition towards renewable energy sources is a key driver for the advanced energy-storage-systems market in China. With the government's ambitious targets for increasing the share of renewables in the energy mix, the need for effective energy storage solutions becomes paramount. The integration of solar and wind energy into the grid presents challenges related to intermittency and reliability. Advanced energy-storage systems provide a viable solution by storing excess energy generated during peak production times and releasing it during periods of low generation. This capability is essential for maintaining grid stability and ensuring a consistent energy supply. As of now, renewable energy sources account for approximately 30% of China's total energy consumption, and this figure is expected to rise, further bolstering the advanced energy-storage-systems market.

Urbanization and Smart City Development

The rapid urbanization in China is creating a pressing need for efficient energy management solutions, thereby driving the advanced energy-storage-systems market. As cities expand, the demand for energy increases, necessitating innovative approaches to energy storage and distribution. The development of smart cities, which leverage technology to enhance urban living, is particularly relevant. Advanced energy-storage systems play a crucial role in these initiatives by enabling the integration of renewable energy sources and optimizing energy consumption. With urban areas projected to house over 70% of China's population by 2030, the advanced energy-storage-systems market is likely to see substantial growth as cities seek to implement sustainable energy solutions.

Technological Innovations in Energy Storage

Technological advancements are significantly influencing the advanced energy-storage-systems market in China. Innovations in battery technologies, such as lithium-ion and solid-state batteries, are enhancing energy density, efficiency, and lifespan. These improvements are crucial for various applications, including electric vehicles and grid storage. The market is witnessing a shift towards more sustainable and cost-effective solutions, with research indicating that the cost of lithium-ion batteries has decreased by nearly 80% over the past decade. This trend is likely to continue, making advanced energy-storage systems more accessible and appealing to consumers and businesses alike. As technology evolves, the advanced energy-storage-systems market is expected to expand, driven by the demand for high-performance energy storage solutions.