Rising Energy Demand

The advanced energy-storage-systems market in Japan is experiencing growth due to the increasing demand for energy. As urbanization and industrial activities expand, energy consumption is projected to rise significantly. According to recent estimates, Japan's energy demand could increase by approximately 10% by 2030. This surge necessitates efficient energy management solutions, making advanced energy-storage systems essential for balancing supply and demand. The ability to store excess energy generated during peak production times and release it during high demand periods is crucial. Consequently, this driver is pivotal in shaping the advanced energy-storage-systems market, as stakeholders seek to enhance energy reliability and sustainability.

Support for Electric Vehicles

The advanced energy-storage-systems market is bolstered by the growing adoption of electric vehicles (EVs) in Japan. With the government aiming for 100% of new vehicle sales to be electric by 2035, the demand for efficient energy storage solutions is expected to rise. EVs require robust battery systems, which in turn drives the need for advanced energy-storage technologies. The market for EV batteries alone is projected to reach ¥2 trillion by 2025, indicating a substantial opportunity for energy-storage systems. This trend not only supports the automotive sector but also enhances the overall energy infrastructure, thereby propelling the advanced energy-storage-systems market forward.

Regulatory Framework and Incentives

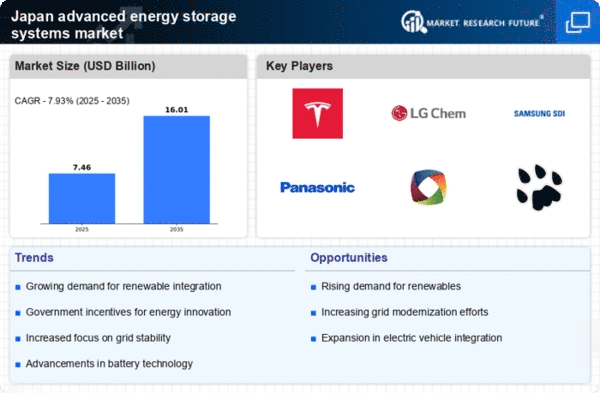

The regulatory environment in Japan plays a vital role in shaping the advanced energy-storage-systems market. The government has implemented various policies and incentives to promote energy efficiency and the adoption of advanced storage technologies. Programs such as subsidies for energy storage installations and tax incentives for renewable energy projects are encouraging investment in this sector. It is estimated that these incentives could lead to a market growth of approximately 20% by 2027. This supportive regulatory framework not only fosters innovation but also enhances the competitiveness of the advanced energy-storage-systems market, making it an attractive area for investment.

Increased Investment in Renewable Energy

Japan's commitment to renewable energy sources is a significant driver for the advanced energy-storage-systems market. Following the Fukushima disaster, the country has shifted its focus towards sustainable energy solutions. The government has set ambitious targets, aiming for renewables to account for 36-38% of the energy mix by 2030. This transition necessitates advanced energy-storage systems to manage the intermittent nature of renewable sources like solar and wind. Investments in these technologies are expected to exceed ¥1 trillion by 2030, highlighting the critical role of energy storage in achieving energy security and sustainability in Japan.

Technological Advancements in Battery Technology

The advanced energy-storage-systems market is significantly influenced by ongoing technological advancements in battery technology. Innovations such as solid-state batteries and lithium-sulfur batteries are enhancing energy density and safety, which are crucial for various applications. The market for advanced batteries is projected to grow at a CAGR of 15% through 2025, driven by the need for more efficient energy storage solutions. These advancements not only improve the performance of energy-storage systems but also reduce costs, making them more accessible for consumers and businesses alike. As technology continues to evolve, it is likely to further stimulate growth in the advanced energy-storage-systems market.