Rising Environmental Concerns

Rising environmental concerns are driving the Chemical Sensors for Liquid Market towards more sustainable practices. As industries face increasing pressure to minimize their environmental footprint, the demand for sensors that can monitor pollutants and hazardous chemicals in liquids is surging. This trend is particularly evident in sectors such as wastewater management and agriculture, where the need for precise monitoring of chemical levels is critical. The market is likely to expand as companies seek to implement eco-friendly solutions, with projections indicating a potential increase in sensor adoption rates by 15% over the next few years. This shift not only addresses regulatory demands but also aligns with corporate sustainability goals.

Expansion of Industrial Applications

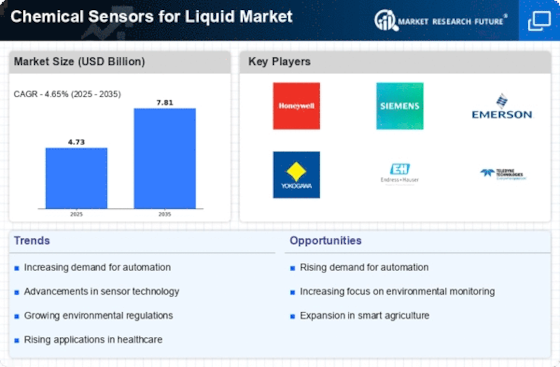

The expansion of industrial applications is a crucial driver for the Chemical Sensors for Liquid Market. Various sectors, including manufacturing, food and beverage, and energy, are increasingly adopting chemical sensors to monitor liquid processes and ensure quality control. The need for precise measurement and monitoring in these industries is paramount, as it directly impacts product quality and safety. Market data indicates that the industrial segment is likely to experience a growth rate of approximately 8% over the next few years. This expansion is fueled by the ongoing industrial automation trends, where chemical sensors play a vital role in enhancing operational efficiency and reducing waste.

Integration of Advanced Technologies

The integration of advanced technologies into the Chemical Sensors for Liquid Market is a pivotal driver. The advent of IoT and AI has enabled the development of smart sensors that provide real-time data and analytics. These innovations enhance the accuracy and efficiency of chemical detection in liquids, catering to industries such as pharmaceuticals and food and beverage. The market for smart sensors is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This technological evolution not only improves operational efficiency but also reduces costs associated with manual monitoring and testing, thereby driving the demand for chemical sensors.

Growing Demand in Healthcare Applications

The growing demand for chemical sensors in healthcare applications is a significant driver for the Chemical Sensors for Liquid Market. With the rise of personalized medicine and point-of-care testing, there is an increasing need for accurate and rapid detection of chemical markers in bodily fluids. This trend is particularly relevant in diagnostics, where timely results can significantly impact patient outcomes. The healthcare sector is projected to account for a substantial share of the market, with estimates suggesting a growth rate of around 12% annually. As technology advances, the integration of chemical sensors into medical devices is expected to enhance diagnostic capabilities and improve patient care.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly influencing the Chemical Sensors for Liquid Market. Governments and regulatory bodies are imposing stringent guidelines to ensure the safety of chemical handling and processing. This has led to a heightened demand for reliable chemical sensors that can accurately monitor liquid compositions and detect hazardous substances. Industries such as oil and gas, water treatment, and food processing are particularly affected, as they must adhere to these regulations. The market is expected to witness growth as companies invest in advanced sensor technologies to meet compliance requirements, thereby enhancing safety and operational integrity.