North America : Market Leader in Services

North America leads the Cement Mixer Repair and Overhaul Services Market, holding a significant share of 1.25B in 2024. The growth is driven by robust construction activities, stringent safety regulations, and a focus on equipment longevity. The demand for efficient repair services is further fueled by the increasing number of construction projects and infrastructure development initiatives across the region. Regulatory frameworks promoting safety and environmental standards also play a crucial role in shaping market dynamics.

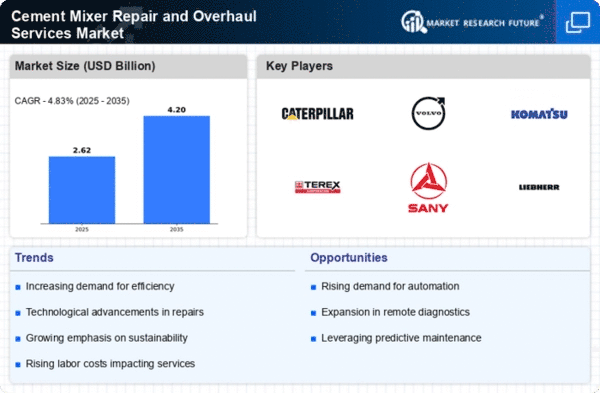

The competitive landscape in North America is characterized by the presence of major players such as Caterpillar Inc, Terex Corporation, and CASE Construction Equipment. These companies leverage advanced technologies and service networks to enhance their offerings. The U.S. stands out as the leading country, with a well-established infrastructure and a high demand for construction equipment repair services. The market is expected to continue its growth trajectory, supported by ongoing investments in infrastructure and construction projects.

Europe : Emerging Market Dynamics

Europe's Cement Mixer Repair and Overhaul Services Market is valued at 0.75B, reflecting a growing demand driven by increasing construction activities and a shift towards sustainable practices. The region is witnessing a rise in regulations aimed at improving equipment efficiency and reducing environmental impact. Countries like Germany and France are leading the charge, with investments in infrastructure projects and a focus on modernizing construction equipment, which is expected to boost repair service demand significantly.

The competitive landscape in Europe features key players such as Volvo Group and Liebherr Group, who are adapting to market needs by offering innovative repair solutions. Germany is a significant market, supported by its strong manufacturing base and technological advancements. The presence of regulatory bodies emphasizes the importance of compliance, ensuring that repair services meet stringent safety and quality standards. This regulatory environment is crucial for fostering market growth and innovation.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region, with a market size of 0.4B, is emerging as a significant player in the Cement Mixer Repair and Overhaul Services Market. The growth is primarily driven by rapid urbanization, increasing infrastructure projects, and a rising demand for construction equipment. Countries like China and India are at the forefront, with substantial investments in infrastructure development, which is expected to create a robust demand for repair services. Regulatory initiatives aimed at enhancing safety and operational efficiency further support market growth.

The competitive landscape in Asia-Pacific is marked by the presence of key players such as SANY Group and Komatsu Ltd. These companies are focusing on expanding their service networks and enhancing their repair capabilities to meet the growing demand. China, being the largest market, is witnessing a surge in construction activities, which is driving the need for efficient repair and overhaul services. The region's potential for growth is immense, with ongoing projects and government support paving the way for future expansion.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa (MEA) region, with a market size of 0.1B, presents emerging opportunities in the Cement Mixer Repair and Overhaul Services Market. The growth is driven by increasing construction activities, particularly in the Gulf Cooperation Council (GCC) countries, where infrastructure development is a priority. Regulatory frameworks are evolving to support safety and efficiency in construction, which is expected to enhance the demand for repair services in the region.

Countries like the UAE and Saudi Arabia are leading the market, with significant investments in construction and infrastructure projects. The competitive landscape includes local and international players who are adapting to the unique market needs. The presence of key players is crucial for driving innovation and improving service delivery. As the region continues to develop, the demand for efficient repair services is anticipated to grow, supported by government initiatives and private sector investments.