Rising Health Consciousness

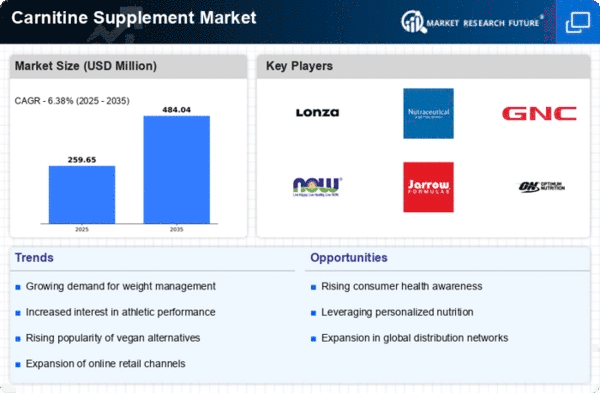

The Global carnitine supplement Market Industry is experiencing a surge in demand driven by increasing health consciousness among consumers. As individuals become more aware of the importance of nutrition and fitness, they are actively seeking supplements that support weight management and enhance athletic performance. This trend is particularly evident in regions with high obesity rates, where consumers are turning to carnitine supplements as a potential solution. The market is projected to reach 1.56 USD Billion in 2024, reflecting a growing inclination towards health-oriented products. This shift in consumer behavior suggests a robust future for the industry as more people prioritize their health.

Expanding Athletic Community

The Global Carnitine Supplement Market Industry is significantly influenced by the expanding athletic community, which includes both professional athletes and fitness enthusiasts. As participation in sports and fitness activities increases globally, there is a corresponding rise in the demand for supplements that can enhance performance and recovery. Carnitine, known for its potential benefits in fat metabolism and energy production, is becoming a staple among athletes. This trend is likely to contribute to the market's growth, with projections indicating an increase to 3.04 USD Billion by 2035. The growing awareness of the benefits of carnitine among athletes suggests a promising trajectory for the industry.

Growing E-Commerce Platforms

The rise of e-commerce platforms is transforming the Global Carnitine Supplement Market Industry by providing consumers with greater accessibility and convenience. Online retailing allows consumers to explore a wide range of carnitine products, compare prices, and read reviews, which enhances their purchasing experience. This shift towards online shopping is particularly appealing to younger demographics who prefer digital solutions. As e-commerce continues to expand, it is anticipated that the market will see increased sales and a broader reach. The convenience of online shopping is likely to play a pivotal role in driving the growth of the industry in the coming years.

Increased Focus on Preventive Healthcare

The Global Carnitine Supplement Market Industry is benefiting from a heightened focus on preventive healthcare. As healthcare costs rise, consumers are increasingly seeking ways to maintain their health and prevent chronic diseases through dietary supplements. Carnitine is often marketed for its potential benefits in supporting metabolic health and enhancing physical performance, making it an attractive option for health-conscious individuals. This trend aligns with the global shift towards preventive measures rather than reactive healthcare, suggesting a sustained demand for carnitine supplements. The industry's growth trajectory appears promising as more consumers prioritize preventive health strategies.

Technological Advancements in Supplement Formulation

Innovations in supplement formulation are playing a crucial role in shaping the Global Carnitine Supplement Market Industry. Advances in technology have led to the development of more effective and bioavailable forms of carnitine, enhancing its absorption and efficacy. Manufacturers are increasingly investing in research and development to create products that cater to specific consumer needs, such as weight loss, muscle recovery, and overall health. This focus on innovation is likely to attract a broader consumer base, thereby driving market growth. As the industry evolves, it is expected to benefit from a compound annual growth rate of 6.22% from 2025 to 2035.