Technological Advancements in Imaging

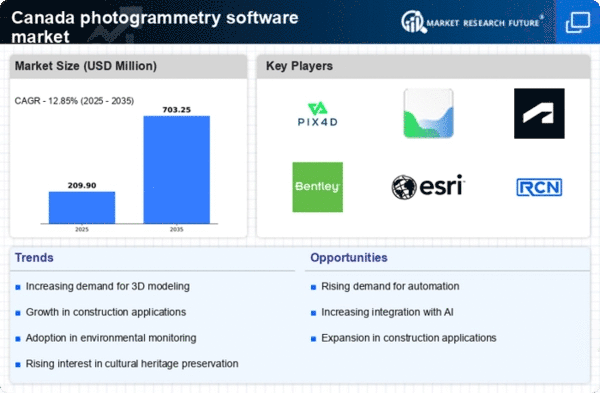

The rapid evolution of imaging technologies is a pivotal driver for the photogrammetry software market. Innovations in camera sensors, such as higher resolution and improved low-light performance, enhance the quality of data captured. This advancement allows for more accurate and detailed 3D models, which are essential in various applications, including surveying and mapping. In Canada, the integration of these technologies is evident, as the market is projected to grow at a CAGR of approximately 15% over the next five years. The increasing demand for high-quality imaging solutions in sectors like construction and agriculture further propels the growth of the photogrammetry software market.

Rising Demand for 3D Mapping Solutions

The growing need for 3D mapping solutions across multiple industries is significantly influencing the photogrammetry software market. Industries such as urban planning, forestry, and mining are increasingly relying on 3D models for better decision-making and resource management. In Canada, the market for 3D mapping is expected to reach $150 million by 2026, driven by the need for precise geographical data. This demand is further fueled by government initiatives aimed at improving infrastructure and environmental monitoring, which necessitate advanced mapping technologies. Consequently, the photogrammetry software market is likely to experience substantial growth as organizations seek to adopt these solutions.

Growing Adoption in Environmental Monitoring

The increasing focus on environmental sustainability is driving the adoption of photogrammetry software in Canada. Organizations are utilizing these tools for environmental monitoring, land use planning, and conservation efforts. The ability to create detailed 3D models of landscapes allows for better analysis of ecological changes and resource management. As environmental regulations become more stringent, the demand for accurate data collection and analysis is expected to rise. The photogrammetry software market is likely to expand as businesses and government agencies seek to comply with these regulations and enhance their environmental stewardship efforts.

Increased Investment in Infrastructure Projects

The Canadian government's commitment to infrastructure development is a crucial driver for the photogrammetry software market. With significant investments earmarked for transportation, utilities, and urban development, the demand for accurate surveying and mapping tools is on the rise. Photogrammetry software plays a vital role in these projects, providing essential data for planning and execution. As of 2025, infrastructure spending in Canada is projected to exceed $200 billion, creating a robust market for photogrammetry solutions. This trend indicates that the photogrammetry software market will likely benefit from the ongoing infrastructure boom, as stakeholders seek efficient and reliable tools for project management.

Expansion of Educational and Research Institutions

The proliferation of educational and research institutions in Canada is fostering growth in the photogrammetry software market. Universities and research centers are increasingly incorporating photogrammetry into their curricula and research projects, thereby creating a skilled workforce adept in these technologies. This trend is likely to enhance the market as graduates enter the workforce with expertise in photogrammetry applications. Furthermore, collaborative research initiatives between academia and industry are expected to drive innovation and development in the software solutions available. As a result, the photogrammetry software market may witness a surge in demand for advanced tools and applications.