Growth in Consumer Electronics

The consumer electronics sector is a significant driver for the lithium ion battery market in Canada. With the proliferation of smartphones, laptops, and wearable devices, the demand for high-performance batteries continues to rise. In 2025, it is estimated that the consumer electronics market in Canada will reach approximately $30 billion, with a substantial portion attributed to battery-powered devices. Lithium ion batteries are preferred for their lightweight and compact design, which aligns with the consumer demand for portable technology. This growth in consumer electronics not only boosts the lithium ion-battery market but also encourages innovation in battery technology, leading to improved performance and efficiency.

Surge in Renewable Energy Storage

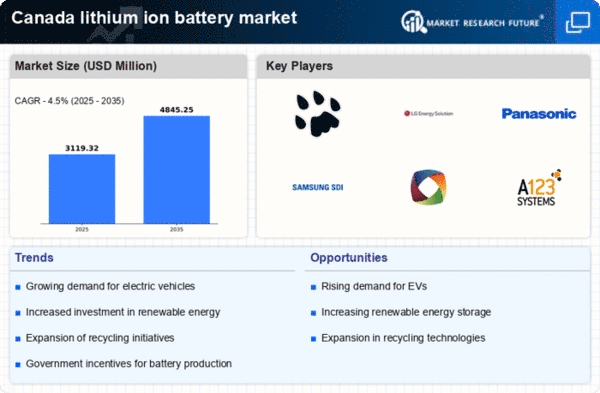

The lithium ion battery market in Canada is experiencing a notable surge due to the increasing demand for renewable energy storage solutions. As Canada aims to transition towards cleaner energy sources, the need for efficient energy storage systems becomes paramount. Lithium ion batteries are favored for their high energy density and longevity, making them ideal for storing energy generated from solar and wind sources. In 2025, the Canadian government reported that renewable energy accounted for approximately 18% of the total energy mix, indicating a growing reliance on these sources. This trend is likely to drive investments in the lithium ion-battery market, as businesses and consumers seek reliable storage options to manage energy supply and demand effectively.

Expansion of Electric Public Transport

The expansion of electric public transport systems in Canada is significantly influencing the lithium ion battery market. Cities are increasingly adopting electric buses and trains to reduce greenhouse gas emissions and improve air quality. In 2025, it is projected that the electric public transport sector will grow by over 25%, necessitating a robust supply of lithium ion batteries to power these vehicles. This shift not only supports environmental goals but also stimulates local economies through job creation in manufacturing and maintenance. The lithium ion-battery market stands to benefit from this trend, as public transport authorities seek reliable and efficient battery solutions to meet operational demands.

Rising Demand for Energy Storage Systems

The rising demand for energy storage systems in Canada is a critical driver for the lithium ion battery market. As more businesses and households seek to enhance energy efficiency and reduce costs, the adoption of energy storage solutions is becoming increasingly prevalent. In 2025, the energy storage market in Canada is expected to grow by approximately 30%, driven by the need for backup power and grid stability. Lithium ion batteries are favored for their scalability and performance, making them suitable for various applications, from residential solar storage to large-scale grid solutions. This trend indicates a robust future for the lithium ion-battery market as it aligns with the broader energy transition goals.

Technological Innovations in Battery Recycling

Technological innovations in battery recycling are emerging as a vital driver for the lithium ion battery market in Canada. As the focus on sustainability intensifies, the recycling of lithium ion batteries is gaining traction. In 2025, advancements in recycling technologies are expected to enhance recovery rates of valuable materials, such as lithium and cobalt, which are essential for battery production. This not only reduces environmental impact but also lowers production costs, potentially making lithium ion batteries more affordable. The lithium ion-battery market is likely to benefit from these innovations, as they promote a circular economy and ensure a sustainable supply chain for battery materials.