Technological Advancements

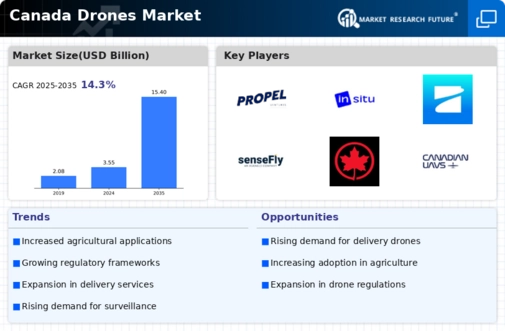

The Canada drones market is experiencing rapid technological advancements that enhance drone capabilities. Innovations in battery life, sensor technology, and artificial intelligence are driving the development of more efficient and versatile drones. For instance, the integration of AI allows for improved navigation and obstacle avoidance, which is crucial for commercial applications. As of 2025, the market for drone technology in Canada is projected to reach CAD 1.5 billion, reflecting a compound annual growth rate of approximately 15%. This growth is indicative of the increasing reliance on drones across various sectors, including agriculture, construction, and surveillance. The continuous evolution of drone technology not only improves operational efficiency but also expands the potential applications within the Canada drones market.

Regulatory Framework Development

The development of a robust regulatory framework is crucial for the growth of the Canada drones market. The Canadian government has been proactive in establishing regulations that ensure the safe operation of drones in various airspaces. Transport Canada has introduced guidelines that facilitate commercial drone operations while prioritizing safety and privacy. As of 2025, the regulatory environment is expected to become more conducive to drone operations, with streamlined processes for obtaining permits and certifications. This regulatory clarity is likely to encourage investment and innovation within the Canada drones market, as businesses will have a clearer understanding of compliance requirements.

Expansion in Agricultural Applications

The agricultural sector is increasingly adopting drone technology, which is a key driver for the Canada drones market. Drones are being utilized for crop monitoring, precision agriculture, and livestock management, providing farmers with valuable data to enhance productivity. In 2025, it is estimated that the agricultural segment will represent a significant portion of the overall drone market in Canada, with a projected growth rate of 20% annually. This expansion is driven by the need for sustainable farming practices and the desire to optimize resource use. The integration of drones into agriculture not only improves efficiency but also supports the broader goals of food security and environmental sustainability within the Canada drones market.

Increased Demand for Aerial Surveillance

The demand for aerial surveillance solutions is significantly influencing the Canada drones market. Various sectors, including law enforcement, environmental monitoring, and infrastructure inspection, are increasingly adopting drones for their surveillance needs. The Canadian government has recognized the potential of drones in enhancing public safety and has initiated programs to integrate drone technology into policing and emergency response. In 2025, it is estimated that the market for surveillance drones in Canada will account for over 30% of the total drone market, driven by the need for real-time data and situational awareness. This trend suggests that the Canada drones market is poised for substantial growth as organizations seek to leverage aerial surveillance capabilities.

Growth in E-commerce and Delivery Services

The rise of e-commerce has created a burgeoning demand for efficient delivery solutions, thereby impacting the Canada drones market. Companies are increasingly exploring drone technology to facilitate last-mile delivery, which is often the most challenging aspect of logistics. In 2025, it is projected that drone deliveries in Canada could account for approximately 20% of all e-commerce deliveries, driven by the need for speed and efficiency. Major retailers and logistics companies are investing in drone technology to enhance their delivery capabilities, which is likely to reshape the logistics landscape. This growth in delivery services indicates a significant opportunity for the Canada drones market to expand and innovate.