Technological Advancements

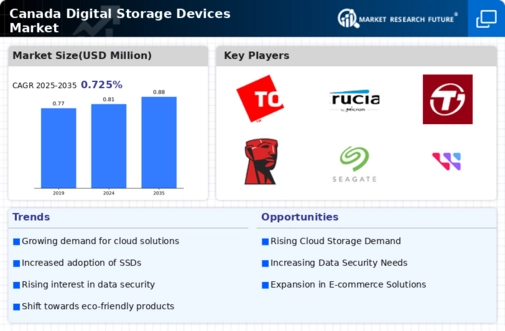

Technological innovations are significantly influencing the Canada digital storage devices market. The advent of solid-state drives (SSDs) and advancements in flash memory technology have revolutionized data storage, offering faster access speeds and improved durability compared to traditional hard disk drives (HDDs). In 2025, SSDs accounted for over 50% of the total storage device sales in Canada, indicating a shift towards more efficient storage solutions. Furthermore, the development of new storage technologies, such as 3D NAND and NVMe, is expected to enhance performance and capacity, catering to the growing demands of consumers and enterprises. As technology continues to evolve, the market is likely to witness the introduction of even more sophisticated storage solutions, further propelling growth in the industry.

Growing Demand for Data Storage

The increasing reliance on digital data across various sectors in Canada is driving the demand for storage solutions. As businesses and individuals generate vast amounts of data, the need for efficient storage devices becomes paramount. In 2025, the Canada digital storage devices market reported a growth rate of approximately 8% annually, reflecting the rising consumption of data storage. This trend is particularly evident in sectors such as healthcare, finance, and education, where data management is critical. The proliferation of smart devices and the Internet of Things (IoT) further exacerbate this demand, as more devices require reliable storage solutions. Consequently, manufacturers are compelled to innovate and expand their product offerings to meet the evolving needs of consumers and businesses alike.

Increased Focus on Data Security

As data breaches and cyber threats become more prevalent, the emphasis on data security within the Canada digital storage devices market is intensifying. Organizations are increasingly seeking storage solutions that offer robust security features, such as encryption and secure access controls. In 2025, approximately 70% of Canadian businesses reported prioritizing data security in their storage purchasing decisions. This trend is driven by regulatory requirements and the need to protect sensitive information from unauthorized access. Consequently, manufacturers are integrating advanced security measures into their products, which not only enhances consumer trust but also positions them competitively in the market. The focus on data security is likely to remain a key driver as businesses continue to navigate the complexities of data protection.

Regulatory Compliance and Data Governance

The evolving regulatory landscape surrounding data protection and privacy is influencing the Canada digital storage devices market. With the implementation of stringent data protection laws, such as the Personal Information Protection and Electronic Documents Act (PIPEDA), organizations are compelled to adopt storage solutions that ensure compliance. In 2025, nearly 60% of Canadian companies indicated that regulatory compliance was a primary factor in their storage purchasing decisions. This focus on data governance not only drives demand for compliant storage solutions but also encourages manufacturers to develop products that align with regulatory standards. As the regulatory environment continues to evolve, the market is likely to see increased demand for storage devices that offer enhanced compliance features.

Rising Adoption of Cloud Storage Solutions

The growing acceptance of cloud storage solutions is reshaping the landscape of the Canada digital storage devices market. As organizations increasingly migrate to cloud-based platforms for data management, the demand for hybrid storage solutions that combine local and cloud storage is on the rise. In 2025, the cloud storage market in Canada is projected to reach CAD 3 billion, reflecting a shift in how data is stored and accessed. This trend is particularly appealing to small and medium-sized enterprises (SMEs) that seek cost-effective and scalable storage options. The integration of cloud services with traditional storage devices is likely to create new opportunities for manufacturers, as they adapt their offerings to meet the changing preferences of consumers and businesses.