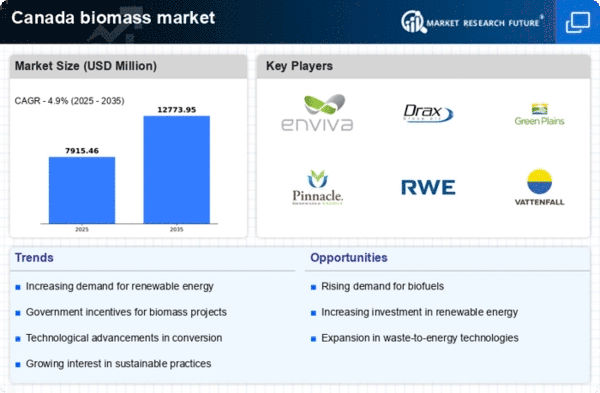

The biomass market exhibits a dynamic competitive landscape characterized by a growing emphasis on sustainability and innovation. Key players such as Pinnacle Renewable Energy (CA), Drax Group (GB), and Enviva Holdings (US) are actively shaping the market through strategic initiatives. Pinnacle Renewable Energy (CA) focuses on expanding its production capacity and enhancing its supply chain efficiency, which positions it favorably in a moderately fragmented market. Drax Group (GB) is leveraging its technological advancements to optimize biomass conversion processes, while Enviva Holdings (US) is pursuing strategic partnerships to bolster its market presence and operational capabilities. Collectively, these strategies contribute to a competitive environment that prioritizes efficiency and sustainability.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing their supply chains to enhance responsiveness to market demands. The biomass market is moderately fragmented, with several players vying for market share. The collective influence of these key players is significant, as they drive innovation and set industry standards, thereby shaping the overall market structure.

In October Pinnacle Renewable Energy (CA) announced a strategic partnership with a leading technology firm to develop advanced biomass processing technologies. This collaboration is expected to enhance Pinnacle's operational efficiency and reduce production costs, thereby strengthening its competitive position. The strategic importance of this partnership lies in its potential to accelerate innovation and improve sustainability practices within the biomass sector.

In September Drax Group (GB) unveiled a new initiative aimed at increasing the use of sustainable biomass in its energy generation processes. This initiative is part of Drax's broader commitment to achieving net-zero emissions by 2030. The strategic significance of this move is profound, as it not only reinforces Drax's leadership in the biomass market but also aligns with global sustainability goals, potentially attracting environmentally conscious investors.

In August Enviva Holdings (US) expanded its operations by acquiring a biomass production facility in Canada. This acquisition is pivotal as it enhances Enviva's production capacity and strengthens its supply chain in North America. The strategic importance of this expansion is underscored by the growing demand for renewable energy sources, positioning Enviva to capitalize on emerging market opportunities.

As of November current competitive trends in the biomass market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are becoming more prevalent, enabling companies to leverage shared resources and expertise. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This shift suggests that companies that prioritize these elements will be better positioned to thrive in an increasingly competitive landscape.