Rising Energy Demand

The increasing The Biomass Power Industry. As populations grow and economies expand, the need for sustainable energy sources becomes more pressing. Biomass power, derived from organic materials, offers a renewable alternative to fossil fuels. In recent years, the energy consumption has surged, with projections indicating a potential increase of 25% by 2030. This trend underscores the necessity for biomass energy solutions, which can help meet the rising demand while reducing greenhouse gas emissions. The Biomass Power Market is thus positioned to play a crucial role in addressing energy needs sustainably.

Technological Innovations

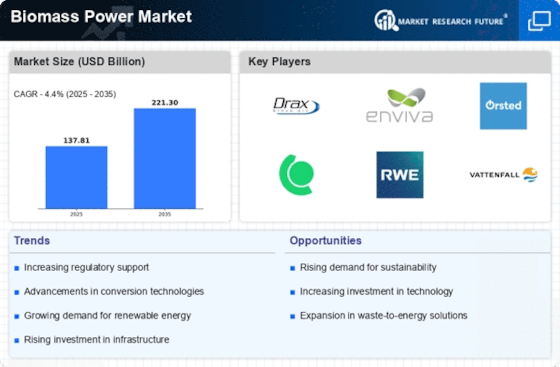

Technological innovations are transforming the Biomass Power Market, enhancing efficiency and reducing costs. Advances in biomass conversion technologies, such as gasification and anaerobic digestion, have improved the viability of biomass as a power source. These innovations enable the conversion of a wider range of feedstocks into energy, thus expanding the market potential. In 2024, it was estimated that technological advancements could increase biomass energy output by up to 40%. This progress not only makes biomass power more competitive but also attracts investment, further propelling the growth of the Biomass Power Market.

Rural Economic Development

The Biomass Power Market is also influenced by its potential to stimulate rural economic development. Biomass energy projects often rely on local agricultural residues and forestry by-products, creating jobs and supporting local economies. In 2023, it was reported that biomass projects generated approximately 100,000 jobs in rural areas. This economic benefit, coupled with the environmental advantages of biomass energy, makes it an attractive option for policymakers. As rural communities seek sustainable development pathways, the Biomass Power Market is likely to see increased investment and support, further driving its growth.

Government Incentives and Policies

Government incentives and supportive policies are pivotal in shaping the Biomass Power Market. Many countries have implemented favorable regulations to promote renewable energy sources, including biomass. For instance, feed-in tariffs and tax credits have been introduced to encourage investment in biomass energy projects. In 2023, it was reported that countries with robust policy frameworks saw a 30% increase in biomass energy production. These incentives not only stimulate market growth but also enhance the competitiveness of biomass power against traditional energy sources. As governments continue to prioritize renewable energy, the Biomass Power Market is likely to benefit significantly.

Environmental Concerns and Climate Change

Growing environmental concerns and the impacts of climate change are driving interest in the Biomass Power Market. As awareness of climate issues rises, there is an increasing push for cleaner energy solutions. Biomass power is viewed as a sustainable alternative that can help mitigate carbon emissions. In 2025, it is anticipated that the biomass sector could contribute to a reduction of up to 15% in overall greenhouse gas emissions. This potential impact positions the Biomass Power Market as a key player in the transition towards a low-carbon economy, appealing to both consumers and investors.