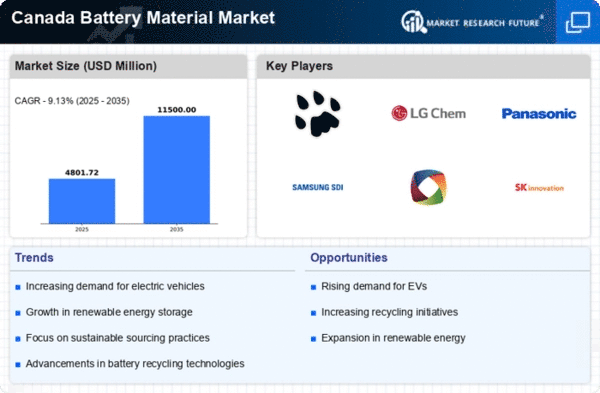

The battery material market in Canada is characterized by a dynamic competitive landscape, driven by increasing demand for electric vehicles (EVs) and renewable energy storage solutions. Key players such as CATL (CN), LG Chem (KR), and Panasonic (JP) are strategically positioning themselves through innovation and regional expansion. CATL, for instance, focuses on enhancing its lithium-ion battery technology, while LG Chem emphasizes sustainable practices in its production processes. These strategies collectively shape a competitive environment that is increasingly focused on technological advancement and sustainability.In terms of business tactics, companies are localizing manufacturing to reduce supply chain vulnerabilities and optimize logistics. The market structure appears moderately fragmented, with several key players exerting influence over their respective segments. This fragmentation allows for a variety of competitive strategies, as companies seek to differentiate themselves through unique offerings and operational efficiencies.

In September LG Chem (KR) announced a partnership with a Canadian mining company to secure a stable supply of lithium, a critical component for battery production. This strategic move is significant as it not only ensures a reliable source of raw materials but also aligns with the growing emphasis on local sourcing to mitigate supply chain risks. Such partnerships are likely to enhance LG Chem's competitive edge in the market.

In October Panasonic (JP) unveiled plans to invest $1 billion in a new battery manufacturing facility in Canada, aimed at increasing production capacity for EV batteries. This investment underscores Panasonic's commitment to meeting the surging demand for EVs and positions the company favorably within the North American market. The establishment of this facility is expected to create numerous jobs and stimulate local economies, further solidifying Panasonic's presence in the region.

In November CATL (CN) launched a new line of solid-state batteries, which are anticipated to offer higher energy density and improved safety compared to traditional lithium-ion batteries. This innovation could potentially revolutionize the battery material market, as solid-state technology is seen as a key advancement in battery performance. CATL's proactive approach to R&D indicates a strong focus on maintaining technological leadership in an increasingly competitive landscape.

As of November current trends in the battery material market include a pronounced shift towards digitalization, sustainability, and the integration of artificial intelligence (AI) in production processes. Strategic alliances are becoming increasingly important, as companies collaborate to enhance their technological capabilities and market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, advanced technology, and supply chain reliability, reflecting the changing demands of consumers and regulatory environments.