Market Growth Projections

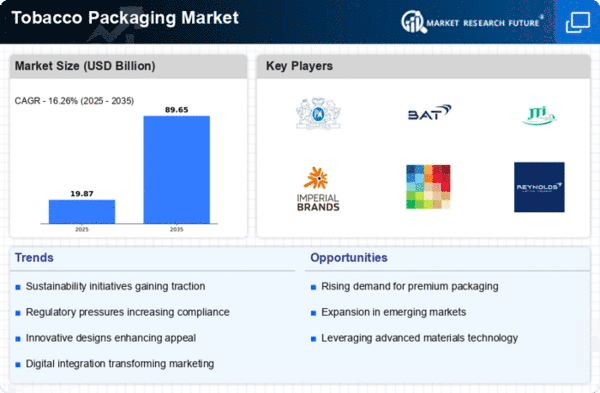

The Global Tobacco Packaging Market Industry is poised for growth, with projections indicating a market value of 30.2 USD Billion in 2024 and an anticipated increase to 38.5 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 2.22% from 2025 to 2035. Factors contributing to this growth include regulatory compliance, sustainability initiatives, and technological advancements. As the industry adapts to these dynamics, it is likely to witness increased investment in innovative packaging solutions that cater to evolving consumer preferences and regulatory demands.

Changing Consumer Preferences

Changing consumer preferences are a significant driver in the Global Tobacco Packaging Market Industry. There is a noticeable shift towards premium and differentiated products, with consumers seeking unique packaging that reflects their personal identity and lifestyle. This trend is evident in the rise of limited edition packaging and collaborations with artists. Such strategies not only enhance brand loyalty but also attract new customers. As the market adapts to these evolving preferences, it is expected to maintain a steady growth trajectory, contributing to the overall market value projected at 30.2 USD Billion in 2024.

Globalization and Market Expansion

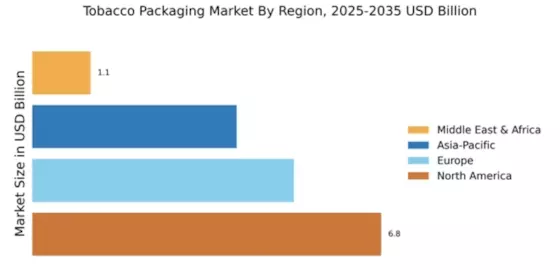

Globalization plays a crucial role in the Global Tobacco Packaging Market Industry. As companies expand their reach into emerging markets, they encounter diverse consumer preferences and regulatory environments. This necessitates tailored packaging solutions that resonate with local cultures while adhering to international standards. For instance, brands entering Asian markets often modify their packaging to align with regional tastes and preferences. This strategic approach not only facilitates market entry but also enhances brand visibility. The industry's expansion efforts are anticipated to drive growth, with projections indicating a market value of 38.5 USD Billion by 2035.

Technological Advancements in Packaging

Technological advancements are reshaping the Global Tobacco Packaging Market Industry. Innovations such as smart packaging, which incorporates QR codes and augmented reality, enhance consumer engagement and provide information on product authenticity. These technologies are particularly appealing to younger demographics who value transparency and interactivity. Furthermore, automation in packaging processes improves efficiency and reduces costs for manufacturers. As the industry embraces these technologies, it is likely to experience a compound annual growth rate of 2.22% from 2025 to 2035, reflecting the positive impact of technological integration.

Sustainability and Eco-Friendly Packaging

Sustainability is becoming a pivotal driver in the Global Tobacco Packaging Market Industry. As consumers become more environmentally conscious, tobacco companies are exploring eco-friendly packaging solutions. This shift includes the use of biodegradable materials and recyclable packaging designs. For example, some brands are now utilizing plant-based inks and sustainable paper sources. This trend not only aligns with consumer preferences but also addresses regulatory pressures regarding environmental impact. The market's growth trajectory suggests a potential increase to 38.5 USD Billion by 2035, indicating a robust demand for sustainable packaging options.

Regulatory Compliance and Packaging Innovations

The Global Tobacco Packaging Market Industry is increasingly influenced by stringent regulations aimed at reducing tobacco consumption. Governments worldwide are implementing packaging requirements that mandate graphic health warnings and plain packaging. For instance, Australia has led the way with its plain packaging laws, which have been adopted by several countries. This regulatory landscape compels manufacturers to innovate in packaging design while ensuring compliance. As a result, the market is projected to reach 30.2 USD Billion in 2024, reflecting the industry's adaptation to these evolving regulations.