Research Methodology on Paper Packaging Market

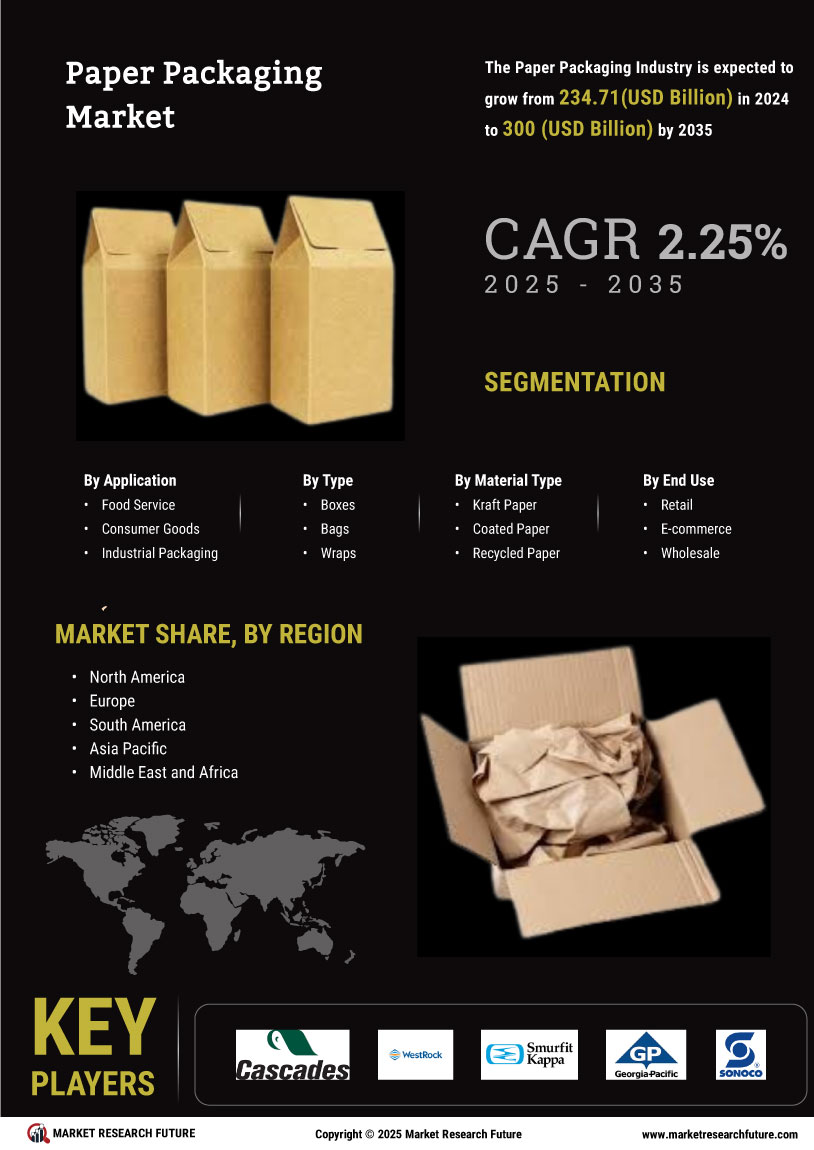

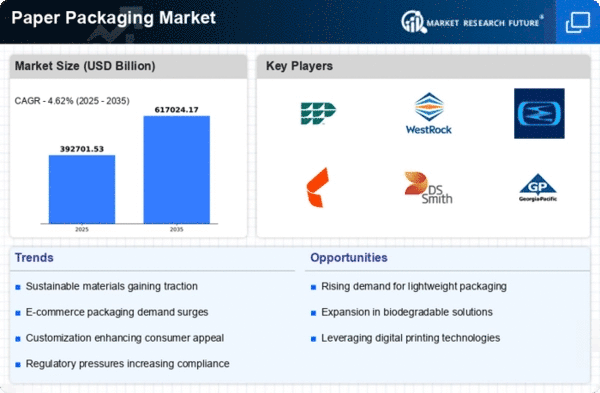

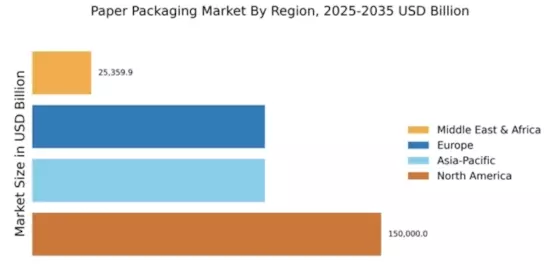

The research report on the Paper Packaging Market by MRFR provides an in-depth analysis of the global paper packaging market in terms of market size, market share, market segmentation, market dynamics, market growth drivers, key consumer trends, product type, end-use segments, value chain, pricing analysis and regional outlook. The report also provides a regional perspective for five global regions: Europe, North America, Latin America, APAC, and the Middle East & Africa.

- Objectives and Research Methodology

The primary objective of this research report is to gain an in-depth understanding of the global paper packaging market and analyze the global demand and supply side variables. The report also examines industry trends, key consumer trends and industry drivers. Market revenue predictions are made for the specified period of 2023-2030.

In order to achieve the set objectives, extensive research methodology is used. Data collection and Analysis involves secondary research, primary research and market surveys to determine market size, market trends, pricing trends and global demand. Primary data is collected through interviews with key decision-makers such as presidents, directors, CEOs, COOs, CFOs, and other business professionals in the paper packaging industry. Market analysts also conducted interviews with technical experts/analysts in order to generate accurate insights.

In addition, five regions have been identified - Europe, North America, Latin America, APAC, and the Middle East & Africa - in order to understand the regional dynamics and analyze new opportunities in the market.

Secondary research involves gathering data from secondary sources such as:

- Database of facts and statistics • Online search engines • News portals and websites • Market research articles and white papers • Government websites and databases

Secondly, the market size and market forecast were estimated using bottom-up and top-down approaches. The bottom-up approach is used to estimate the global paper packaging market size by Region & Country and divided into product types. A top-down approach is used to validate the market size on the basis of reference data.

In order to get a concise perspective of the overall market and segmentation, data triangulation is used, which involves the blending of several methods and data sources which help to increase the accuracy of the market research report published.

Primary research includes creating data points from industry experts with the help of questionnaires, surveys and interviews. The industry experts include managers and CXOs from various key organizations in the paper packaging market.

In order to gain deep insights into the market, market surveys were also conducted in various countries. These surveys also include product and pricing analysis. The survey was conducted for a period of two months, and the results were analyzed and integrated with the data collected from secondary sources.

The market model validation is done in two steps. Firstly, historical data is collected, analyzed and projected to identify the market size in terms of volume and value (2023-2030). Secondly, a market survey is conducted to validate the model and the projected results.

The global paper packaging market is segmented on the basis of product type, end-use industry, and geography.

By Product Type:

- Corrugated packaging • Solid board packaging • Paperboard packaging

By End-Uses Industry:

- Food & Beverage • Pharmaceutical • Personal Care • Home & Cosmetic • Automotive • Electronics

By Region:

- Europe • North America • Latin America • Asia-Pacific • The Middle East & Africa

- Conclusion

Through this research report, readers will understand the global paper packaging market structure and its segmentation. This report also provides insights into the key consumer trends, market dynamics and market growth drivers to identify different market growth prospects. The report also analyzes regional dynamics and evaluates key opportunities across various regions. In summary, this research report provides a detailed assessment of the global paper packaging market, providing the necessary information for companies to make informed decisions and capitalize on upcoming growth opportunities in the paper packaging market.