Tobacco Packaging Size

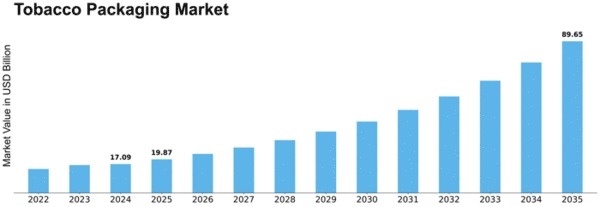

Tobacco Packaging Market Growth Projections and Opportunities

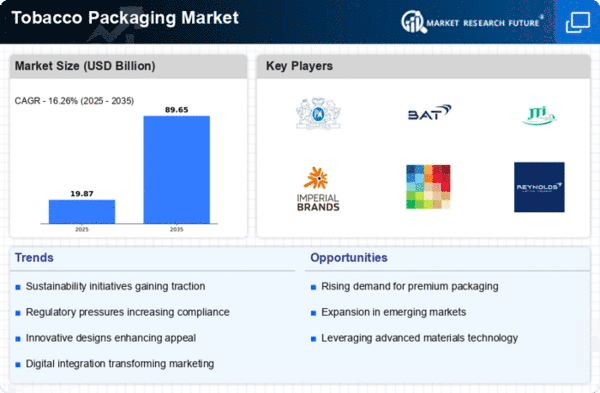

Many factors affect the tobacco packaging market's dynamics and growth. Tobacco usage patterns worldwide affect packaging solution demand. The packaging market must adjust to shifting smoking behaviors as some regions see a fall and others constant or increase. Government regulations and anti-smoking initiatives also affect the tobacco sector, requiring producers to use more sustainable and health-friendly packaging.

The tobacco packaging market is shaped by consumer preferences. Target demographics determine design, material, and functionality trends.This shift toward greener choices has led tobacco packaging producers to experiment with recyclable materials.

Health authorities worldwide enforce strict laws that shape the tobacco packaging market. Graphic health warnings, plain packaging, and marketing and advertising limits are becoming government priorities. These restrictions require tobacco packaging producers to use standardized designs and health warnings. Companies engage in complying and innovative packaging solutions to traverse the difficult regulatory environment, affecting the market.

Technology also shapes the tobacco packaging sector. The industry has adopted smart packaging technologies including track-and-trace systems to improve product security and combat illegal trading. Innovations in printing technology enable detailed, high-quality packaging designs, boosting brand distinction and consumer appeal. To meet demand for unique and engaging product presentation, manufacturers have adopted digital printing technology to create bespoke and eye-catching packaging.

Global economic factors and trade dynamics affect tobacco package manufacture and distribution. Currency exchange rates, trade tariffs, and geopolitical conflicts affect manufacturing prices and raw material availability. Since tobacco is a worldwide commodity, international trade agreements and legislation can affect the supply chain and packaging needs.

Key players' strategies influence the tobacco packaging market's competitive landscape. Mergers, acquisitions, and collaborations affect market concentration, whereas innovations and R&D boost competitiveness. To satisfy tobacco makers' diversified needs, tobacco packaging companies offer pouches, cartons, and new dispensing techniques.

Leave a Comment