Oil and Gas Exploration Activities

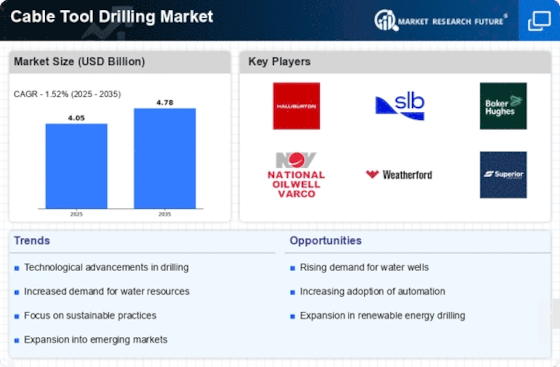

The Cable Tool Drilling Market is significantly influenced by ongoing oil and gas exploration activities. As energy demands continue to escalate, companies are investing in advanced drilling technologies to enhance extraction efficiency. Cable tool drilling, with its ability to reach deeper reservoirs, is becoming a preferred method in various exploration projects. Recent statistics reveal that the oil and gas sector is expected to witness a growth rate of around 4.5% annually, which could lead to increased utilization of cable tool drilling techniques. This trend indicates a potential surge in demand for cable tool drilling services, as operators seek to maximize their resource recovery.

Infrastructure Development Projects

Infrastructure development projects are a driving force behind the Cable Tool Drilling Market. Governments and private entities are increasingly investing in construction and civil engineering projects, necessitating reliable drilling methods for foundation work and utility installations. Cable tool drilling is particularly advantageous in urban settings where precision and minimal disruption are required. The market for construction drilling services is anticipated to grow at a rate of 6% per year, reflecting the rising need for effective drilling solutions. This growth may lead to a greater emphasis on cable tool drilling, as it offers a robust solution for various infrastructure applications.

Increased Demand for Water Resources

The Cable Tool Drilling Market experiences heightened demand for water resources, particularly in arid regions where groundwater extraction is essential. As populations grow and agricultural needs expand, the necessity for efficient drilling techniques becomes paramount. Cable tool drilling, known for its reliability and effectiveness in penetrating hard rock formations, is increasingly favored. Recent data indicates that the market for water well drilling is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years. This trend suggests that investments in cable tool drilling technologies will likely rise, as stakeholders seek to optimize water extraction processes and ensure sustainable water supply.

Regulatory Support for Resource Extraction

Regulatory support for resource extraction is a significant driver in the Cable Tool Drilling Market. Governments are increasingly recognizing the importance of sustainable resource management and are implementing policies that facilitate responsible drilling practices. This regulatory environment encourages investment in cable tool drilling, as it aligns with environmental standards and promotes efficient resource utilization. Recent legislative changes in various regions indicate a trend towards more favorable conditions for drilling operations, which could enhance market growth. As regulations evolve, the cable tool drilling sector may see increased activity, driven by compliance and the need for sustainable practices.

Technological Innovations in Drilling Equipment

Technological innovations play a crucial role in shaping the Cable Tool Drilling Market. The introduction of advanced drilling equipment and techniques enhances operational efficiency and safety. Innovations such as automated drilling systems and improved cable tool designs are likely to attract more operators to this method. Recent market analyses suggest that the adoption of new technologies could increase productivity by up to 20%, thereby making cable tool drilling more appealing. As the industry evolves, the integration of cutting-edge technologies may lead to a more competitive landscape, further driving the demand for cable tool drilling services.