Growing Awareness and Education

The rising awareness regarding the importance of early diagnosis and treatment of respiratory diseases is significantly influencing the Bronchoscopy Market. Educational initiatives aimed at both healthcare professionals and patients are fostering a better understanding of bronchoscopy procedures and their benefits. This increased awareness is likely to lead to higher patient referrals for bronchoscopy, as individuals become more proactive about their respiratory health. Furthermore, healthcare providers are investing in training programs to enhance the skills of practitioners in performing bronchoscopy, which may contribute to improved procedural outcomes. As a result, the Bronchoscopy Market is expected to expand as more patients seek these essential diagnostic services.

Increase in Geriatric Population

The demographic shift towards an aging population is a significant factor driving the Bronchoscopy Market. Older adults are more susceptible to respiratory diseases due to age-related physiological changes and comorbidities. As the global population ages, the demand for bronchoscopy procedures is likely to increase, as these individuals often require advanced diagnostic and therapeutic interventions for respiratory conditions. Data suggests that the geriatric population is projected to grow substantially in the coming years, further emphasizing the need for effective healthcare solutions. Consequently, the Bronchoscopy Market is expected to benefit from this demographic trend, as healthcare systems adapt to meet the needs of an older population.

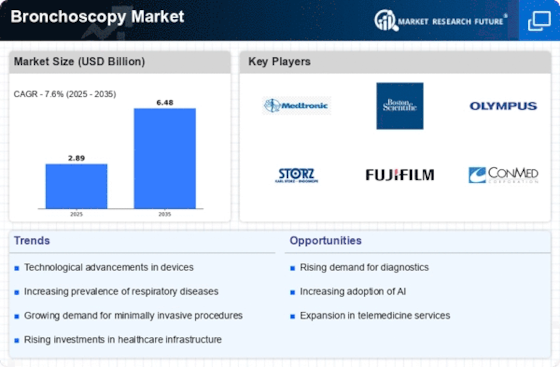

Rising Incidence of Respiratory Diseases

The increasing prevalence of respiratory diseases, such as chronic obstructive pulmonary disease (COPD) and lung cancer, is a primary driver of the Bronchoscopy Market. According to recent data, respiratory diseases account for a significant portion of global morbidity and mortality. The World Health Organization indicates that COPD alone affects millions worldwide, necessitating advanced diagnostic and therapeutic interventions. As healthcare systems strive to address this growing burden, the demand for bronchoscopy procedures is likely to rise. This trend is further supported by the development of innovative bronchoscopy technologies that enhance diagnostic accuracy and treatment efficacy. Consequently, the Bronchoscopy Market is poised for substantial growth as healthcare providers seek effective solutions to manage and treat respiratory conditions.

Technological Innovations in Bronchoscopy

Technological advancements play a crucial role in shaping the Bronchoscopy Market. Innovations such as robotic-assisted bronchoscopy and advanced imaging techniques have revolutionized the field, allowing for more precise and less invasive procedures. For instance, the introduction of electromagnetic navigation bronchoscopy has improved the ability to access peripheral lung lesions, which was previously challenging. These advancements not only enhance patient outcomes but also increase the efficiency of procedures, thereby attracting more healthcare facilities to adopt bronchoscopy technologies. As a result, the market is experiencing a surge in demand for these cutting-edge tools, which are expected to drive growth in the Bronchoscopy Market over the coming years.

Regulatory Support and Reimbursement Policies

Supportive regulatory frameworks and favorable reimbursement policies are essential drivers of the Bronchoscopy Market. Governments and health organizations are increasingly recognizing the value of bronchoscopy in diagnosing and treating respiratory diseases, leading to improved reimbursement rates for these procedures. This financial support encourages healthcare providers to invest in bronchoscopy technologies and expand their service offerings. Additionally, regulatory bodies are streamlining approval processes for new bronchoscopy devices, facilitating quicker access to innovative solutions. As a result, the Bronchoscopy Market is likely to experience growth as healthcare providers are incentivized to adopt and implement advanced bronchoscopy techniques.