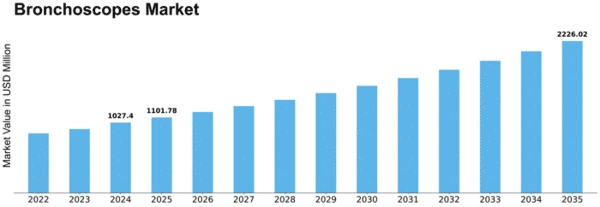

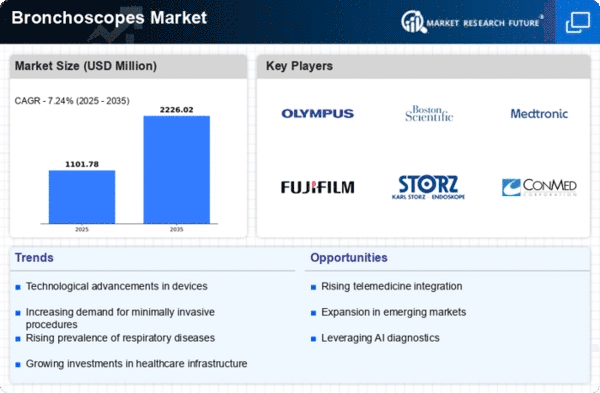

Bronchoscopes Size

Bronchoscopes Market Growth Projections and Opportunities

Bronchoscopy is a medical procedure where a doctor looks inside a patient's airways and lungs to find any problems or unusual things. This can include things like foreign objects, possible tumors, bleeding, or inflammation. The first bronchoscopy was done in 1897 by a doctor named Gustav Killian from Germany. Initially, rigid bronchoscopes were used, but in the 1970s, flexible fiberoptic bronchoscopes were introduced, which became very popular for their improved capabilities. This invention made bronchoscopy an important tool for diagnosing and treating chest and respiratory diseases. Nowadays, it's the most common way doctors check the lungs. The global study on bronchoscopes includes estimating the market size, understanding market growth, identifying factors that contribute to growth, and looking at the volume of bronchoscopes and their types. The market is divided into different types of bronchoscopes, their uses, the people who use them, and the regions they are used in worldwide. This study helps us understand how bronchoscopes are used around the world. It looks at the different types of bronchoscopes, what they are used for, who uses them, and where they are used. The first bronchoscopy, done by Gustav Killian in 1897, used rigid bronchoscopes. These were hard and inflexible. But in the 1970s, flexible fiberoptic bronchoscopes came into use. They were more flexible and had better capabilities. This change was a crucial invention that made bronchoscopy more important for diagnosing and treating diseases in the chest and respiratory system. Nowadays, bronchoscopy is the most common way doctors examine the lungs. It helps them find issues like foreign objects, tumors, bleeding, or inflammation. The global study on bronchoscopes is about figuring out how big the market is, how it's growing, what drives its growth, and how many bronchoscopes of different types are used. The market is divided into categories based on the types of bronchoscopes, their uses, who uses them, and where they are used in the world. This information helps us see the big picture of how bronchoscopes are a crucial tool in the medical field, helping diagnose and treat diseases related to the chest and respiratory system.

Leave a Comment