Innovation in Brewing Techniques

The brewery Market is experiencing a notable shift towards innovative brewing techniques. This trend is driven by the increasing demand for unique flavors and styles among consumers. Breweries are experimenting with various ingredients, fermentation processes, and aging methods to create distinctive products. For instance, the use of barrel-aging and wild fermentation has gained traction, appealing to craft beer enthusiasts. According to recent data, the craft beer segment has seen a growth rate of approximately 4% annually, indicating a robust interest in artisanal products. This innovation not only enhances product offerings but also fosters brand loyalty, as consumers are drawn to breweries that push the boundaries of traditional brewing.

Health Consciousness Among Consumers

The brewery Market is witnessing a significant shift in consumer preferences towards healthier options. As health consciousness rises, breweries are adapting their product lines to include low-calorie and low-alcohol beverages. This trend is particularly evident in the growing popularity of non-alcoholic and low-alcohol beers, which have seen a surge in demand. Recent statistics suggest that the non-alcoholic beer segment is projected to grow at a compound annual growth rate of 7% over the next five years. This shift reflects a broader societal trend where consumers are increasingly mindful of their health and wellness, prompting breweries to innovate and diversify their offerings to cater to this evolving market.

Emerging Markets and Global Expansion

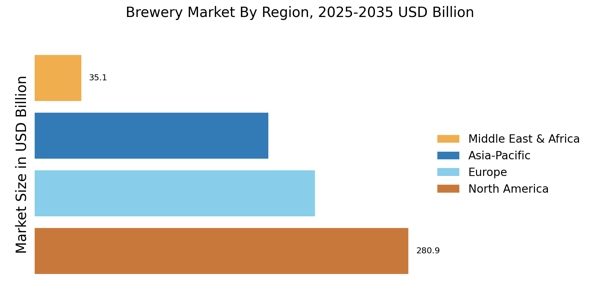

The Brewery Market is witnessing growth in emerging markets, presenting new opportunities for expansion. As disposable incomes rise in various regions, there is an increasing demand for premium and craft beer products. Breweries are exploring international markets to tap into this potential, often adapting their offerings to local tastes and preferences. Data suggests that regions such as Asia and Africa are experiencing rapid growth in beer consumption, with projections indicating a compound annual growth rate of 5% over the next decade. This expansion not only diversifies revenue streams for breweries but also fosters cultural exchange through the introduction of diverse beer styles.

E-commerce and Direct-to-Consumer Sales

The Brewery Market is increasingly embracing e-commerce and direct-to-consumer sales channels. This shift is largely driven by changing consumer behaviors, as more individuals prefer the convenience of online shopping. Breweries are leveraging digital platforms to reach a wider audience, offering home delivery and subscription services. Data indicates that online sales of alcoholic beverages have grown significantly, with projections suggesting a continued upward trajectory. This trend not only enhances accessibility for consumers but also allows breweries to build direct relationships with their customers, fostering brand loyalty. As e-commerce continues to evolve, breweries that adapt to this model may find themselves at a competitive advantage in the marketplace.

Sustainability and Environmental Responsibility

The Brewery Market is increasingly focused on sustainability and environmental responsibility. As consumers become more environmentally conscious, breweries are adopting practices that minimize their ecological footprint. This includes sourcing local ingredients, reducing water usage, and implementing recycling programs. Recent studies indicate that breweries that prioritize sustainability can enhance their brand image and attract a loyal customer base. Furthermore, the market for sustainable products is expanding, with consumers willing to pay a premium for environmentally friendly options. This trend not only aligns with consumer values but also positions breweries as leaders in the movement towards a more sustainable future.