North America : Market Leader in Innovation

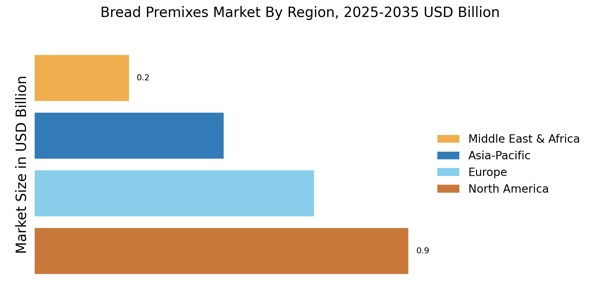

North America is the largest market for bread premixes, holding approximately 40% of the global market share. The region's growth is driven by increasing consumer demand for convenience foods, health-conscious products, and innovative baking solutions. Regulatory support for food safety and quality standards further catalyzes market expansion, encouraging manufacturers to invest in advanced technologies and sustainable practices.

The United States is the primary contributor to this market, with key players like General Mills, Cargill, and Archer Daniels Midland leading the competitive landscape. The presence of established distribution networks and a strong retail sector enhances market accessibility. Additionally, the trend towards artisanal and specialty breads is pushing companies to diversify their product offerings, ensuring a robust competitive environment.

Europe : Emerging Trends in Baking

Europe is witnessing significant growth in the bread premixes market, accounting for approximately 30% of the global share. The region's demand is fueled by a rising trend towards artisanal and organic products, alongside increasing consumer awareness regarding health and nutrition. Regulatory frameworks, such as the EU's food safety regulations, promote high-quality standards, further driving market growth and innovation in product development.

Leading countries in this region include Germany, France, and the UK, where companies like Lesaffre and Associated British Foods are prominent. The competitive landscape is characterized by a mix of large corporations and small artisanal producers, fostering innovation and diversity in product offerings. The focus on sustainability and clean label products is reshaping the market, encouraging brands to adapt to evolving consumer preferences.

Asia-Pacific : Rapid Growth and Expansion

Asia-Pacific is rapidly emerging as a significant player in the bread premixes market, holding around 20% of the global share. The region's growth is driven by urbanization, changing lifestyles, and a growing middle class with increasing disposable income. Additionally, the demand for convenience foods and ready-to-eat products is on the rise, supported by favorable government policies promoting food innovation and safety standards.

Countries like China, India, and Japan are leading the market, with a competitive landscape featuring both local and international players. Companies such as Puratos and Dawn Foods are expanding their presence, catering to diverse consumer preferences. The region's unique culinary traditions are also influencing product development, leading to a variety of premixes tailored to local tastes and preferences, enhancing market dynamism.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is gradually emerging in the bread premixes market, currently holding about 10% of the global share. The growth is primarily driven by increasing urbanization, a young population, and rising demand for convenience foods. Regulatory initiatives aimed at improving food safety and quality standards are also contributing to market expansion, encouraging investment in local production facilities and supply chains.

Leading countries in this region include South Africa, UAE, and Egypt, where the market is characterized by a mix of local and international players. Companies like Kerry Group and Mühlenchemie are establishing a foothold, focusing on product innovation and catering to regional tastes. The competitive landscape is evolving, with opportunities for growth in both retail and food service sectors, as consumer preferences shift towards ready-to-use baking solutions.