Rising Focus on Cost Efficiency

Cost efficiency remains a critical concern for telecom operators in Brazil, driving the adoption of virtualized evolved-packet-core solutions. As competition intensifies, operators are seeking ways to reduce operational costs while maintaining service quality. Virtualization allows for the consolidation of network functions, which can lead to significant savings in hardware and maintenance expenses. Reports indicate that companies adopting virtualized solutions have experienced cost reductions of up to 30%. This trend is likely to continue as more operators recognize the financial benefits of transitioning to a virtualized infrastructure. Consequently, the virtualized evolved-packet-core market is expected to thrive as operators prioritize cost-effective solutions to enhance their competitive edge.

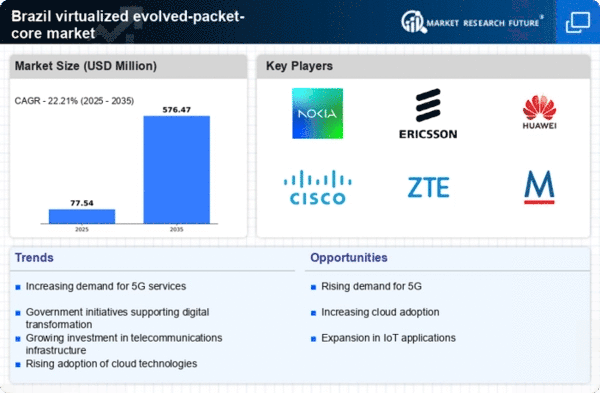

Shift Towards 5G Network Deployment

The ongoing shift towards 5G network deployment in Brazil is a significant driver for the virtualized evolved-packet-core market. As telecom operators prepare for the rollout of 5G, there is a growing need for advanced core network solutions that can handle increased data traffic and provide low-latency services. The Brazilian government has set ambitious targets for 5G coverage, aiming for 50% of urban areas to be connected by 2026. This initiative is likely to create substantial opportunities for the virtualized evolved-packet-core market, as operators will require scalable and flexible solutions to support the new technology. Market analysts predict that investments in 5G infrastructure could reach $10 billion by 2026, further underscoring the potential for growth in this sector.

Growing Demand for High-Speed Connectivity

The increasing demand for high-speed connectivity in Brazil is a primary driver for the virtualized evolved-packet-core market. As consumers and businesses alike seek faster internet services, telecom operators are compelled to upgrade their infrastructure. This shift towards high-speed networks is expected to boost the market significantly. According to recent data, the number of broadband subscriptions in Brazil has risen by approximately 10% annually, indicating a robust appetite for enhanced connectivity. The virtualized evolved-packet-core market is poised to benefit from this trend, as it enables operators to deliver faster and more reliable services. Furthermore, Initiatives by the Brazilian government to expand internet access in rural areas may further stimulate demand, creating a favorable environment for market growth..

Increased Investment in Digital Transformation

The ongoing digital transformation across various sectors in Brazil is a key driver for the virtualized evolved-packet-core market. Businesses are increasingly investing in digital technologies to improve operational efficiency and customer experience. This trend is reflected in the telecommunications sector, where operators are modernizing their networks to support digital services. The Brazilian government has also launched initiatives to promote digitalization, which could lead to an estimated investment of $5 billion in telecommunications infrastructure over the next few years. As companies seek to leverage advanced technologies, the demand for virtualized evolved-packet-core solutions is likely to rise, positioning the market for substantial growth in the coming years.

Regulatory Support for Telecommunications Innovation

Regulatory frameworks in Brazil are increasingly supportive of telecommunications innovation, which serves as a catalyst for the virtualized evolved-packet-core market. The National Telecommunications Agency (ANATEL) has implemented policies that encourage the adoption of new technologies, including virtualization. This regulatory support is crucial as it allows telecom operators to invest in modern infrastructure without facing excessive bureaucratic hurdles. The Brazilian government has also allocated funds to promote technological advancements in the sector, which could lead to a projected market growth of 15% over the next five years. Such favorable regulations not only enhance competition but also drive the adoption of virtualized solutions, thereby benefiting the virtualized evolved-packet-core market.