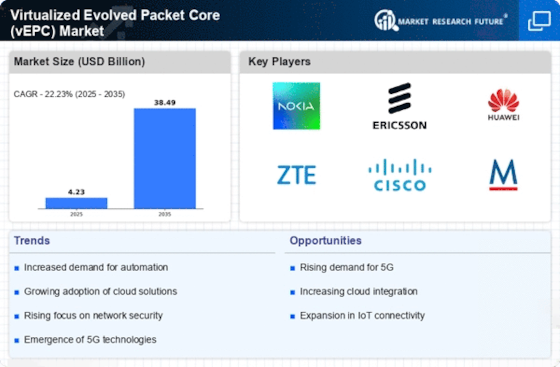

Leading market players are investing heavily in research and development to expand their product lines, which will help the Virtualized Evolved Packet Core Market (vEPC) market grow even more. Market participants are also undertaking various strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Virtualized Evolved Packet Core Market (vEPC) industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the global Virtualized Evolved Packet Core Market (vEPC) industry to benefit clients and increase the market sector. In recent years, the Virtualized Evolved Packet Core Market (vEPC) industry has offered some of the most significant advantages to technology. Major players in the Virtualized Evolved Packet Core Market (vEPC) market, including Nokia Corporation (Finland), Cisco System Inc. (US), Huawei Technologies Co.

Ltd. (China), NEC Corporation (Japan), Ericsson AB (Sweden), SAMSUNG (South Korea), ZTE Corporation (China), Mitel Networks Corporation (US), Affirmed Networks (US), Athonet S.R.L.(Italy), and others, are attempting to increase market demand by investing in research and development operations.

Nokia Corporation is a multinational company that specializes in consumer electronics, information technology, and telecommunications. Nokia Corporation is also known as Nokia in Finnish and Swedish. The headquater of Nokia are situated in Espoo, Finland. The company was established in 1865. For instance: In September 2022, Nokia launched its newest Software-as-a-Service (SaaS) solution, Visualization, Automation, and Analytics (AVA) charging, intended to assist Communication Service Providers (CSPs) and enterprises in efficiency releasing new offerings for 5G and IoT usage cases.

With its ‘Intelligence Everywhere’ method, Machine Learning (ML), AVA Charging leverages Artificial Intelligence (AI), Open APIs, no code configuration, multi-cloud orchestration and digital ecosystems to bring comprehensive capabilities.

Telefonaktiebolaget LM Ericcson, also known as Ericcson, is a global Swedish networking and telecommunications corporation headquartered in Stockholm. For telecom service providers and businesses, the company supplies software, infrastructure, and services in information and communications technology, and optical transport systems. Over 1, 00,000 individuals work for the corporation, which operates in over 180 nations. Over 57,000 awarded patents belong to Erricson. One of the pioneers in 5G, Ericsson has made important contributions to the growth of the telecom sector. For Instance: In February 2023, Ericsson and Econet will roll out 5G in Zimbave.

Due to the cooperation, Econet will have access to Ericsson’s most recent Radio Access Network (RAN) and 5G Evolved Packet Core (EPC) solutions, which are much faster than 4G and will improve user experience and capacity.