Growing Demand for Scalability

The microservices architecture market in Brazil is experiencing a notable surge in demand for scalable solutions. As businesses expand, they require systems that can efficiently handle increased workloads without compromising performance. This architecture allows organizations to develop and deploy applications in a modular fashion, enabling them to scale individual components as needed. According to recent data, approximately 70% of Brazilian enterprises are prioritizing scalability in their IT strategies. This trend is likely to drive investments in microservices, as companies seek to enhance their operational efficiency and responsiveness to market changes. The ability to quickly adapt to customer needs and market dynamics positions microservices architecture as a critical enabler for growth in the Brazilian business landscape.

Enhanced Collaboration and Agility

The microservices architecture market in Brazil is being propelled by the need for enhanced collaboration and agility within development teams. As organizations adopt agile methodologies, the demand for architectures that support rapid development cycles is increasing. Microservices facilitate this by allowing teams to work on different components simultaneously, thereby reducing time-to-market for new features and products. Approximately 65% of Brazilian companies report that improving collaboration among teams is a top priority. This focus on agility is likely to drive the adoption of microservices, as businesses seek to respond swiftly to customer feedback and market demands, ultimately leading to improved competitiveness.

Increased Focus on Cost Efficiency

Cost efficiency remains a pivotal driver for the microservices architecture market in Brazil. Organizations are increasingly seeking ways to optimize their IT expenditures while maintaining high service quality. Microservices enable companies to deploy only the necessary components, reducing resource wastage and operational costs. A recent survey revealed that around 55% of Brazilian firms are prioritizing cost-effective solutions in their IT investments. This trend suggests that businesses are likely to adopt microservices architecture to achieve better financial performance and resource allocation. By leveraging microservices, organizations can enhance their ability to innovate while keeping costs under control, thereby fostering a more sustainable business model.

Rise of Digital Transformation Initiatives

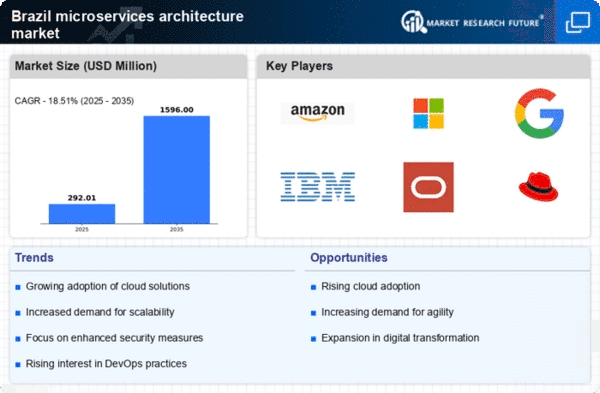

In Brazil, the ongoing digital transformation initiatives across various sectors are significantly influencing the microservices architecture market. Organizations are increasingly adopting digital technologies to improve customer experiences and streamline operations. This shift is prompting a transition from monolithic applications to microservices, which offer greater flexibility and faster deployment times. Recent statistics indicate that over 60% of Brazilian companies are investing in digital transformation, with a substantial portion of this budget allocated to microservices solutions. As businesses strive to remain competitive in a rapidly evolving digital landscape, the microservices architecture market is poised for substantial growth, driven by the need for innovative and agile IT frameworks.

Growing Ecosystem of Tools and Technologies

The microservices architecture market in Brazil is benefiting from the expanding ecosystem of tools and technologies designed to support microservices development and deployment. As more companies recognize the advantages of microservices, the demand for specialized tools, such as container orchestration platforms and API management solutions, is on the rise. Recent data indicates that the market for microservices-related tools in Brazil is projected to grow by approximately 40% over the next few years. This growth is likely to enhance the overall adoption of microservices architecture, as organizations gain access to a wider array of resources that facilitate the implementation and management of microservices-based applications.