Emergence of DevOps Culture

The emergence of a DevOps culture in Japan is significantly impacting the microservices architecture market. This cultural shift emphasizes collaboration between development and operations teams, fostering a more integrated approach to software delivery. Microservices architecture aligns well with DevOps principles, as it allows for continuous integration and continuous deployment (CI/CD) practices. Recent reports indicate that approximately 75% of organizations in Japan are adopting DevOps methodologies, which is likely to drive the demand for microservices. The synergy between DevOps and microservices architecture is expected to enhance operational efficiency and accelerate innovation, making it a vital driver for the microservices architecture market. This cultural transformation reflects a broader trend towards more collaborative and efficient software development processes.

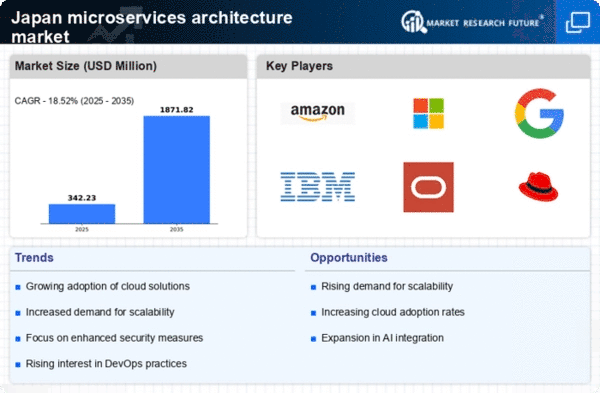

Growing Demand for Scalability

The microservices architecture market in Japan is experiencing a notable surge in demand for scalability solutions. As businesses increasingly seek to enhance their operational efficiency, the ability to scale applications seamlessly becomes paramount. This architecture allows organizations to deploy services independently, facilitating rapid scaling in response to fluctuating user demands. According to recent data, approximately 70% of enterprises in Japan are prioritizing scalable solutions to accommodate their growth strategies. This trend is likely to drive investments in microservices architecture, as companies recognize the need for flexible and adaptable systems that can evolve with market conditions. The growing demand for scalability is thus a critical driver for the microservices architecture market, as it aligns with the broader objectives of digital transformation and operational agility.

Increased Focus on Cost Efficiency

Cost efficiency is emerging as a crucial driver for the microservices architecture market in Japan. Organizations are increasingly seeking ways to optimize their IT expenditures while maintaining high service quality. Microservices architecture enables businesses to deploy only the necessary services, reducing resource consumption and operational costs. Recent analyses indicate that companies adopting microservices can achieve cost savings of up to 30% compared to traditional monolithic architectures. This financial incentive is likely to encourage more enterprises in Japan to transition towards microservices, as they aim to streamline operations and enhance profitability. The focus on cost efficiency thus represents a key driver for the microservices architecture market, reflecting the ongoing pursuit of sustainable business practices.

Shift Towards Agile Development Practices

In Japan, the microservices architecture market is significantly influenced by the shift towards agile development practices. Organizations are increasingly adopting agile methodologies to enhance collaboration, speed up delivery, and improve product quality. Microservices architecture complements these practices by enabling teams to work on different services concurrently, thereby reducing time-to-market. Recent surveys indicate that over 60% of software development teams in Japan are implementing agile frameworks, which in turn fosters a greater reliance on microservices. This alignment between agile practices and microservices architecture is likely to propel market growth, as companies strive to remain competitive in a rapidly evolving technological landscape. The emphasis on agility is thus a vital driver for the microservices architecture market, reflecting a broader trend towards iterative and responsive development.

Rising Need for Enhanced System Resilience

the microservices architecture market in Japan is experiencing a rising need for enhanced system resilience.. As organizations increasingly rely on digital platforms, the ability to maintain service continuity during failures is critical.. Microservices architecture inherently supports resilience by isolating services, allowing for independent recovery and minimizing downtime. Recent statistics suggest that businesses in Japan are investing approximately $1 billion annually in resilience strategies, with microservices playing a pivotal role. This focus on resilience is likely to drive further adoption of microservices architecture, as companies seek to mitigate risks associated with system failures and ensure uninterrupted service delivery. The growing emphasis on resilience thus serves as a significant driver for the microservices architecture market, aligning with the broader objectives of risk management and operational stability.