Enhanced Development Speed

In the microservices architecture market, the acceleration of development speed is a driving force for Canadian businesses. By breaking down applications into smaller, manageable services, organizations can streamline their development processes. This modular approach enables teams to work concurrently on different components, significantly reducing time-to-market for new features and updates. Recent statistics indicate that companies utilizing microservices can achieve a 30% reduction in development time compared to traditional monolithic architectures. This increased efficiency is particularly advantageous in competitive industries, where rapid innovation is essential. As a result, is poised for growth as more Canadian firms adopt this approach to enhance their development capabilities..

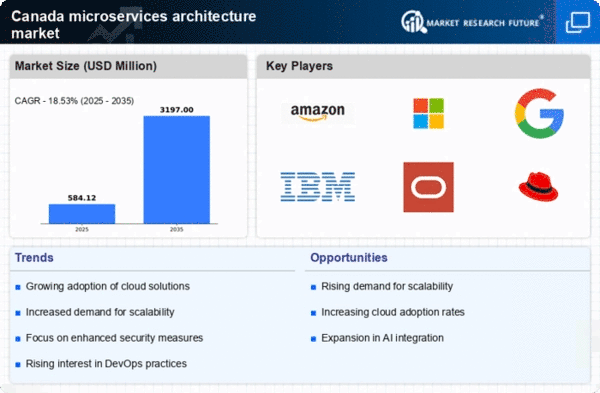

Growing Demand for Scalability

The microservices architecture market is experiencing a notable surge in demand for scalability among Canadian enterprises. As businesses increasingly seek to enhance their operational efficiency, the ability to scale applications seamlessly becomes paramount. This architecture allows organizations to deploy and manage services independently, facilitating rapid scaling in response to fluctuating workloads. According to recent data, approximately 65% of Canadian companies are prioritizing scalable solutions to accommodate their growth strategies. This trend is particularly evident in sectors such as finance and e-commerce, where the need for agility and responsiveness is critical. Consequently, is likely to expand as organizations recognize the benefits of adopting scalable frameworks that align with their evolving business needs..

Increased Focus on Customer Experience

is increasingly influenced by the emphasis on enhancing customer experience among Canadian enterprises.. Organizations are recognizing that delivering personalized and responsive services is essential for maintaining competitive advantage. Microservices enable businesses to develop and deploy features that cater to specific customer needs rapidly. This flexibility allows for continuous improvement based on user feedback, which is crucial in today’s fast-paced market. Data indicates that companies prioritizing customer-centric approaches can see a 20% increase in customer satisfaction. As Canadian businesses strive to elevate their service offerings, the microservices architecture market is expected to grow in tandem with this focus on customer experience.

Integration with Emerging Technologies

The integration of emerging technologies is a pivotal driver in the microservices architecture market, particularly within the Canadian context. As organizations explore the potential of technologies such as IoT, blockchain, and advanced analytics, the need for a flexible architecture becomes evident. Microservices facilitate the seamless integration of these technologies, allowing businesses to innovate and adapt quickly. For instance, the ability to connect IoT devices with microservices can enhance data processing capabilities and improve operational efficiency. Current trends suggest that approximately 50% of Canadian firms are investing in microservices to support their digital transformation initiatives. This integration capability positions the microservices architecture market for substantial growth as businesses seek to leverage new technologies.

Cost Efficiency and Resource Optimization

Cost efficiency remains a critical driver in the microservices architecture market, particularly for Canadian organizations aiming to optimize their IT expenditures. By leveraging microservices, companies can allocate resources more effectively, reducing operational costs associated with maintaining monolithic systems. This architecture allows for the deployment of only the necessary services, which can lead to significant savings. Reports suggest that organizations can reduce infrastructure costs by up to 40% through the adoption of microservices. Furthermore, the ability to utilize cloud resources dynamically contributes to this cost-effectiveness. As Canadian businesses continue to seek ways to enhance their financial performance, the microservices architecture market is likely to benefit from this focus on resource optimization.