Rising Demand for Data-Driven Insights

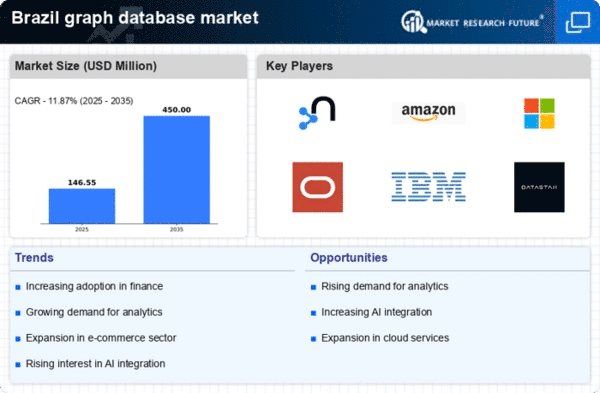

The graph database market in Brazil is experiencing a notable surge in demand for data-driven insights across various sectors. Organizations are increasingly recognizing the value of leveraging complex data relationships to enhance decision-making processes. This trend is particularly evident in industries such as finance and telecommunications, where the ability to analyze interconnected data can lead to improved customer experiences and operational efficiencies. According to recent estimates, the Brazilian market for graph databases is projected to grow at a CAGR of approximately 25% over the next five years. This growth is driven by the need for businesses to harness data effectively, thereby propelling the graph database market forward.

Increased Focus on Cybersecurity Measures

As cyber threats continue to evolve, the graph database market in Brazil is witnessing an increased focus on cybersecurity measures. Organizations are recognizing the importance of securing their data assets, particularly in sectors such as finance and healthcare, where sensitive information is prevalent. Graph databases, with their ability to model complex relationships, can enhance security protocols by providing insights into potential vulnerabilities and attack vectors. This heightened awareness of cybersecurity is likely to drive investments in graph database technologies, as companies seek to protect their data while maintaining operational efficiency. The market is expected to see a rise in demand for graph databases that incorporate advanced security features.

Growing Interest in Social Network Analysis

The growing interest in social network analysis is emerging as a key driver for the graph database market in Brazil. Businesses and researchers are increasingly utilizing graph databases to analyze social interactions and relationships, which can yield valuable insights for marketing strategies and public health initiatives. The ability to visualize and analyze complex networks allows organizations to identify influencers and understand community dynamics. As social media usage continues to rise, the demand for tools that can effectively analyze these networks is likely to increase. This trend suggests a promising future for the graph database market, as it aligns with the evolving needs of data analysis in a connected world.

Expansion of E-Commerce and Digital Services

The rapid expansion of e-commerce and digital services in Brazil significantly influences the graph database market. As online platforms proliferate, businesses require robust data management solutions to handle vast amounts of interconnected data. Graph databases offer the flexibility and scalability needed to manage complex relationships between products, customers, and transactions. This is particularly crucial for companies aiming to personalize user experiences and optimize supply chains. The e-commerce sector in Brazil is expected to reach a valuation of over $30 billion by 2025, further driving the demand for advanced data solutions, including graph databases, to support this growth.

Government Initiatives Supporting Technology Adoption

Government initiatives in Brazil aimed at fostering technological innovation play a crucial role in the growth of the graph database market. Programs designed to promote digital transformation across various sectors encourage businesses to adopt advanced data management solutions. The Brazilian government has allocated significant funding towards technology development, which includes support for data analytics and database technologies. This proactive approach is likely to enhance the adoption of graph databases, as organizations seek to comply with new regulations and leverage data for strategic advantages. The graph database market stands to benefit from these initiatives, as they create an environment conducive to technological advancement.