Expansion of Retail Channels

The expansion of retail channels in Brazil is poised to significantly impact the fragrance market. Traditional brick-and-mortar stores are increasingly complemented by online platforms, providing consumers with a wider array of purchasing options. The rise of beauty and personal care e-commerce is particularly noteworthy, with online sales expected to account for over 30% of total fragrance sales by 2025. This shift in shopping behavior suggests that brands must adapt their strategies to cater to both in-store and online consumers. Additionally, the emergence of pop-up shops and experiential retail concepts may enhance consumer engagement, allowing brands to create memorable experiences that foster loyalty within the fragrance market.

Growing Middle-Class Population

The expanding middle-class population in Brazil appears to be a significant driver for the fragrance market. As disposable incomes rise, consumers are increasingly willing to invest in personal care products, including fragrances. This demographic shift suggests a potential increase in demand for both luxury and affordable fragrance options. In 2025, the middle-class segment is projected to account for approximately 50% of the total population, which could lead to a substantial boost in sales within the fragrance market. Furthermore, the growing trend of self-care and personal grooming among this demographic indicates that the fragrance market may experience sustained growth as consumers seek to express their individuality through scent.

Cultural Significance of Fragrance

In Brazil, fragrance holds a unique cultural significance that drives its market. The tradition of using scents for personal expression and social occasions is deeply rooted in Brazilian culture. Events such as Carnival and various festivals often see heightened fragrance consumption, as individuals seek to enhance their presence and identity through scent. This cultural affinity for fragrances suggests that the fragrance market may continue to thrive, particularly during festive seasons. Additionally, the market is likely to benefit from the increasing popularity of local and artisanal brands that resonate with consumers' desire for authenticity and cultural connection. This trend could lead to a diversification of offerings within the fragrance market.

Rising Demand for Natural Ingredients

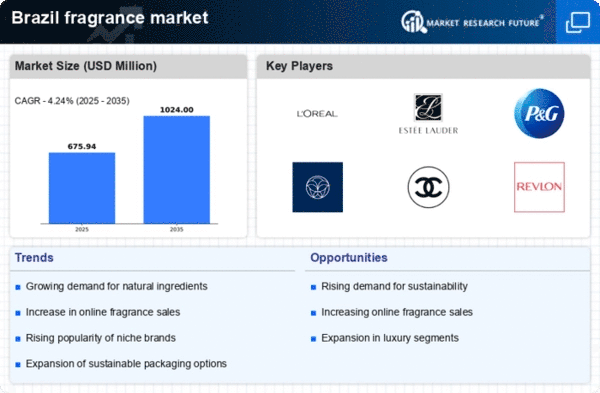

The fragrance market in Brazil is witnessing a notable shift towards natural and organic ingredients. As consumers become more health-conscious and environmentally aware, there is a growing preference for products that are free from synthetic chemicals. This trend is reflected in the increasing sales of natural fragrances, which are projected to grow by approximately 15% annually. Brands that emphasize sustainability and the use of eco-friendly materials are likely to gain a competitive edge in the fragrance market. This shift not only aligns with consumer preferences but also encourages innovation in product development, as companies explore new ways to create appealing scents using natural resources.

Influence of Social Media and Digital Marketing

The impact of social media and digital marketing on consumer behavior is becoming increasingly pronounced in Brazil, particularly within the fragrance market. Brands are leveraging platforms like Instagram and TikTok to engage with younger audiences, showcasing their products through influencers and targeted advertising. This strategy appears to resonate well, as studies indicate that around 70% of Brazilian consumers are influenced by social media when making purchasing decisions. Consequently, the fragrance market is likely to see a rise in online sales, with e-commerce becoming a vital channel for distribution. The ability to reach a broader audience through digital means may enhance brand visibility and drive growth in this competitive landscape.