Expansion of Retail Channels

The expansion of retail channels is a vital driver in the perfume and fragrances market. Traditional brick-and-mortar stores are increasingly complemented by online platforms, allowing consumers to access a wider range of products. The rise of e-commerce has transformed the shopping experience, enabling consumers to purchase fragrances from the comfort of their homes. Data indicates that online sales of perfumes are projected to grow significantly, with estimates suggesting a growth rate of over 10% in the coming years. This expansion is further supported by the development of omnichannel strategies, where brands integrate online and offline experiences to enhance customer engagement. As a result, the accessibility of fragrances is improving, catering to diverse consumer preferences and driving overall market growth.

Rising Demand for Luxury Products

The increasing demand for luxury products is a notable driver in the perfume and fragrances market. Consumers are increasingly seeking high-end fragrances that offer unique scents and premium packaging. This trend is particularly evident in emerging markets, where disposable income is rising, leading to a greater willingness to invest in luxury items. According to recent data, the luxury fragrance segment is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is fueled by a shift in consumer preferences towards premium brands, which are perceived as status symbols. As a result, brands are focusing on creating exclusive and limited-edition fragrances to cater to this affluent consumer base, thereby enhancing their market presence.

Growing Awareness of Natural Ingredients

The growing awareness of natural ingredients is emerging as a significant driver in the perfume and fragrances market. Consumers are increasingly concerned about the ingredients used in their personal care products, leading to a shift towards fragrances that utilize organic and sustainably sourced materials. This trend is reflected in the rising popularity of niche brands that emphasize natural formulations, which are perceived as healthier and more environmentally friendly. Market data suggests that the segment of natural and organic fragrances is expected to witness a growth rate of around 7% annually, as consumers prioritize transparency and sustainability in their purchasing choices. This shift not only influences product development but also encourages established brands to reformulate their offerings to align with consumer preferences.

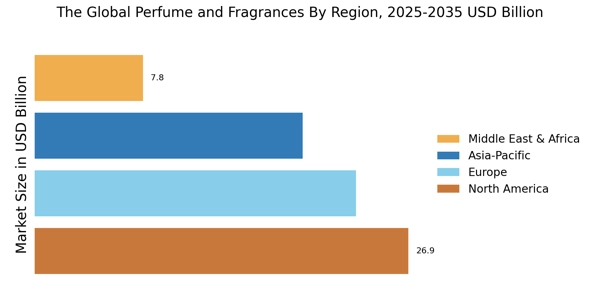

Cultural Influences and Regional Preferences

Cultural influences and regional preferences are essential drivers in the perfume and fragrances market. Different cultures have distinct fragrance preferences, which can significantly impact product development and marketing strategies. For instance, Middle Eastern consumers often favor rich, oriental scents, while Western markets may lean towards fresh and floral fragrances. This diversity necessitates a tailored approach to fragrance offerings, as brands seek to resonate with local tastes. Market data suggests that regional preferences can lead to variations in sales, with certain fragrances performing exceptionally well in specific markets. Understanding these cultural nuances allows brands to create targeted marketing campaigns and product lines, ultimately enhancing their competitiveness in the global landscape.

Influence of Social Media and Celebrity Endorsements

The influence of social media and celebrity endorsements plays a crucial role in shaping consumer preferences within the perfume and fragrances market. Platforms such as Instagram and TikTok have become vital marketing tools, allowing brands to reach a broader audience. The rise of beauty influencers and celebrities promoting specific fragrances has led to increased visibility and desirability of certain products. Data indicates that fragrances endorsed by celebrities often experience a significant spike in sales, with some brands reporting increases of up to 30% following a high-profile endorsement. This trend suggests that social media not only enhances brand awareness but also drives consumer purchasing decisions, making it a pivotal factor in the market's growth.