Emergence of Mobile CRM Solutions

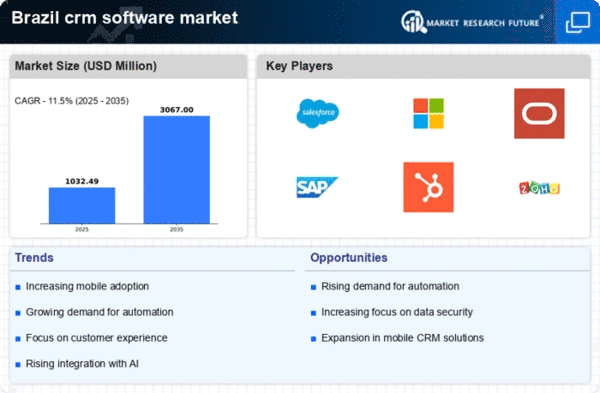

The rise of mobile technology is reshaping the crm software market in Brazil. With an increasing number of professionals working remotely or on-the-go, the demand for mobile crm solutions is on the rise. Recent data suggests that mobile crm adoption has grown by 25% in the past year, as businesses seek to empower their sales teams with real-time access to customer information. This trend indicates a shift towards flexibility and accessibility in customer relationship management. As mobile solutions become more prevalent, organizations are likely to invest in crm software that offers robust mobile capabilities, further driving growth in the crm software market.

Increased Focus on Marketing Automation

In Brazil, the crm software market is witnessing a surge in the adoption of marketing automation tools. Businesses are recognizing the potential of automating marketing processes to enhance efficiency and effectiveness. Recent studies indicate that companies utilizing marketing automation experience a 14.5% increase in sales productivity. This trend is particularly relevant as organizations strive to optimize their marketing efforts and improve lead generation. By integrating crm software with marketing automation, businesses can create targeted campaigns that resonate with their audience, ultimately leading to higher conversion rates. This focus on automation is likely to propel the crm software market forward.

Rising Demand for Customer-Centric Solutions

The crm software market in Brazil is experiencing a notable shift towards customer-centric solutions. Businesses are increasingly recognizing the importance of understanding customer needs and preferences. This trend is driven by the desire to enhance customer satisfaction and loyalty. According to recent data, approximately 70% of Brazilian companies are prioritizing customer experience initiatives, which directly influences their investment in crm software. As organizations seek to tailor their offerings, the demand for sophisticated crm systems that provide insights into customer behavior is likely to grow. This shift not only enhances customer relationships but also drives revenue growth, making it a critical driver in the crm software market.

Growth of E-commerce and Digital Sales Channels

The expansion of e-commerce in Brazil is significantly impacting the crm software market. With online sales projected to reach $30 billion by 2025, businesses are increasingly turning to crm solutions to manage customer interactions across digital platforms. The integration of crm systems with e-commerce platforms allows companies to streamline their sales processes and improve customer engagement. As more consumers prefer online shopping, the need for effective customer relationship management becomes paramount. This trend suggests that companies investing in crm software are better positioned to capitalize on the growing digital sales landscape, thereby driving growth in the crm software market.

Regulatory Compliance and Data Management Needs

The crm software market in Brazil is also influenced by the growing emphasis on regulatory compliance and data management. With the implementation of data protection laws, businesses are increasingly required to manage customer data responsibly. This has led to a heightened demand for crm solutions that offer robust data management features. Companies are seeking software that not only helps them comply with regulations but also enhances their ability to analyze customer data effectively. As organizations navigate the complexities of data compliance, the crm software market is likely to see increased investment in solutions that address these critical needs.