Emergence of IoT Devices

The proliferation of Internet of Things (IoT) devices in Brazil is a crucial driver for the big data market. As more devices become interconnected, the volume of data generated is expected to increase exponentially. By 2025, it is projected that Brazil will have over 1 billion IoT devices in operation, contributing to a data surge that necessitates advanced big data solutions. This influx of data presents both challenges and opportunities for the big data market, as organizations must develop strategies to manage and analyze vast amounts of information. Consequently, the demand for big data technologies and services is likely to rise, enabling businesses to derive actionable insights from IoT-generated data.

Increased Focus on Cybersecurity

As data breaches and cyber threats become more prevalent, the focus on cybersecurity is intensifying within the big data market. In Brazil, organizations are investing heavily in cybersecurity measures to protect sensitive data and maintain consumer trust. The cybersecurity market is anticipated to grow to $10 billion by 2025, reflecting a growing recognition of the importance of data protection. This heightened emphasis on security is likely to drive demand for big data solutions that incorporate robust security features. Consequently, the big data market is adapting to these needs, offering products and services that not only analyze data but also ensure its integrity and confidentiality.

Rising Demand for Data Analytics

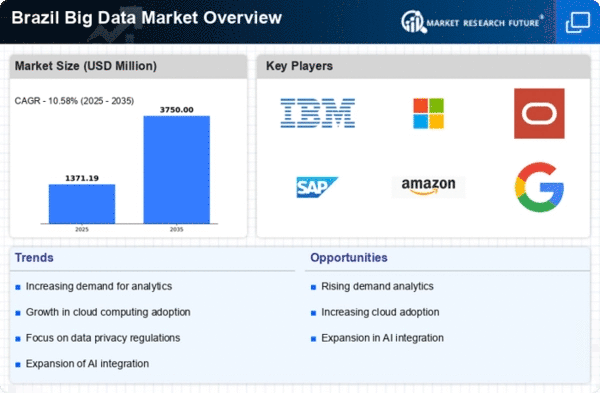

The increasing demand for data analytics in Brazil is a pivotal driver for the big data market. Organizations across various sectors are recognizing the value of data-driven decision-making. In 2025, it is estimated that the analytics market in Brazil will reach approximately $2 billion, reflecting a growth rate of around 25% annually. This surge is largely attributed to businesses seeking to enhance operational efficiency and customer engagement through data insights. As companies invest in advanced analytics tools, the big data market is poised to expand significantly, fostering innovation and competitive advantage. Furthermore, the integration of analytics into business strategies is becoming essential, as firms aim to leverage data for strategic planning and market positioning.

Government Initiatives and Support

Government initiatives aimed at promoting digital transformation are significantly influencing the big data market in Brazil. The Brazilian government has launched various programs to encourage the adoption of technology and data analytics across industries. For instance, investments in infrastructure and technology education are expected to exceed $1 billion by 2026. These initiatives not only facilitate the growth of the big data market but also create a favorable environment for startups and established companies alike. By fostering a culture of innovation and providing financial incentives, the government is likely to enhance the capabilities of businesses to harness big data effectively, thereby driving market growth.

Growth of E-commerce and Digital Services

The rapid expansion of e-commerce and digital services in Brazil is significantly impacting the big data market. With online retail sales projected to reach $50 billion by 2025, businesses are increasingly relying on data analytics to understand consumer behavior and optimize their offerings. This trend is driving investments in big data technologies, as companies seek to analyze customer data for personalized marketing and improved user experiences. The big data market is thus experiencing a transformation, as organizations leverage data to enhance operational efficiency and drive sales growth. As e-commerce continues to flourish, the demand for sophisticated data solutions is expected to escalate, further propelling market development.