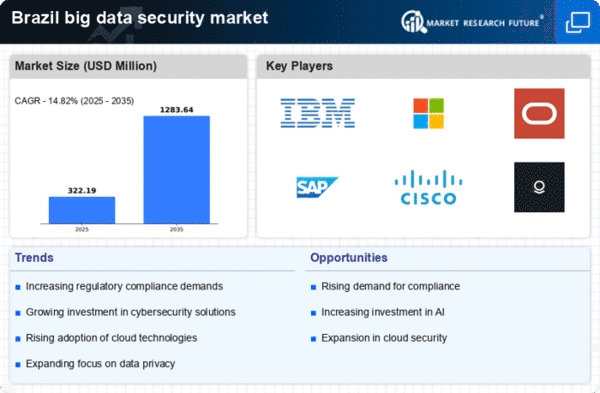

Growing Regulatory Landscape

Brazil's evolving regulatory landscape surrounding data protection is significantly influencing the big data-security market. The implementation of stringent regulations, such as the General Data Protection Law (LGPD), has compelled organizations to enhance their data security practices. Compliance with these regulations is not merely a legal obligation; it is also a competitive necessity. Companies that fail to adhere to these regulations may face hefty fines, which can reach up to 2% of their annual revenue. As a result, businesses are increasingly investing in comprehensive security solutions to ensure compliance and protect consumer data. This regulatory pressure is expected to drive the growth of the big data-security market, as organizations seek to avoid penalties and maintain customer trust.

Adoption of Cloud Technologies

The rapid adoption of cloud technologies in Brazil is reshaping the big data security market.. As more organizations migrate their operations to the cloud, the need for robust security measures becomes paramount. Cloud environments present unique challenges, including data accessibility and potential vulnerabilities. According to recent studies, approximately 70% of Brazilian companies are expected to utilize cloud services by the end of 2025. This shift necessitates the implementation of advanced security protocols to safeguard sensitive information stored in the cloud. Consequently, The big data-security market is likely to experience substantial growth. Businesses are investing in cloud security solutions to protect their data from unauthorized access and breaches..

Increased Awareness of Data Privacy

There is a growing awareness of data privacy among consumers and businesses in Brazil, which is driving the big data-security market. As individuals become more informed about their rights regarding personal data, they are demanding greater transparency and security from organizations. This shift in consumer expectations is prompting businesses to prioritize data protection measures. Surveys indicate that over 60% of Brazilian consumers are concerned about how their data is being used, leading companies to adopt more stringent security practices. This heightened awareness is likely to result in increased investments in data security solutions, as organizations strive to meet consumer demands and maintain their reputation in the market.

Rising Data Breaches and Cyber Threats

The increasing frequency of data breaches and cyber threats in Brazil has become a critical driver for the big data-security market. In recent years, the number of reported incidents has surged.. In recent years, the number of reported incidents has surged, prompting organizations to prioritize their cybersecurity measures. According to government reports, Brazil experienced a 30% rise in cyberattacks in 2025 alone. This alarming trend has led businesses to invest heavily in advanced security solutions to protect sensitive data. The big data-security market is expected to grow as companies seek to mitigate risks associated with data breaches, which can result in significant financial losses and reputational damage. As organizations become more aware of the potential consequences of inadequate security, the demand for robust data protection strategies is likely to increase, further fueling market growth.

Technological Advancements in Security Solutions

Technological advancements in security solutions are playing a pivotal role in shaping the big data-security market in Brazil. Innovations such as machine learning, artificial intelligence, and advanced encryption techniques are enhancing the effectiveness of data protection measures. These technologies enable organizations to detect and respond to threats more efficiently, thereby reducing the risk of data breaches. As businesses seek to leverage these advancements, the demand for sophisticated security solutions is expected to rise. The big data-security market is likely to benefit from this trend, as companies invest in cutting-edge technologies to bolster their defenses against evolving cyber threats.