Market Analysis

In-depth Analysis of BPO Business Analytics Market Industry Landscape

The market dynamics of the Business Process Outsourcing (BPO) Business Analytics market reveal a dynamic landscape influenced by various factors driving its growth and evolution. BPO Business Analytics, which involves outsourcing analytics processes and services to third-party providers, has emerged as a strategic imperative for organizations seeking to leverage data-driven insights to optimize business operations, enhance decision-making, and drive competitive advantage. One of the primary drivers propelling the growth of the BPO Business Analytics market is the exponential growth in data volume, variety, and velocity across industries. As organizations accumulate vast amounts of data from disparate sources, there is an increasing demand for analytics expertise and resources to extract actionable insights and unlock the value hidden within the data.

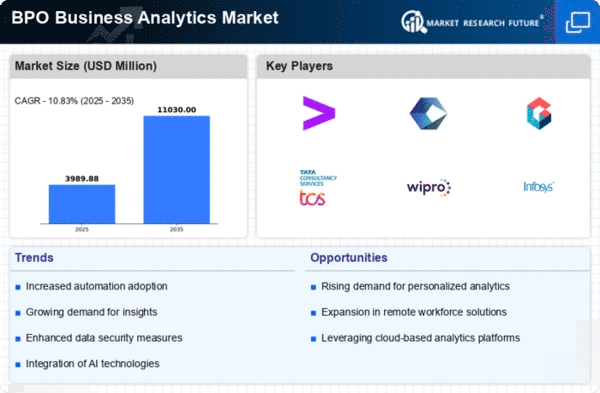

The competitive landscape of the BPO Business Analytics market is marked by intense competition among established BPO service providers, consulting firms, and technology vendors offering analytics solutions and services. Global players such as Accenture, IBM, and Deloitte dominate the market with comprehensive analytics offerings encompassing data management, predictive modeling, and business intelligence. Simultaneously, niche players and specialized analytics firms are gaining traction with domain-specific expertise and industry-focused solutions tailored to the unique requirements of different sectors. This competitive intensity drives continuous innovation, with providers focusing on delivering advanced analytics capabilities, scalable infrastructure, and value-added services to differentiate themselves in the market.

Customer demand and industry trends play a significant role in shaping the dynamics of the BPO Business Analytics market. Organizations across various sectors, including finance, healthcare, retail, and manufacturing, are increasingly turning to BPO Business Analytics providers to augment their internal capabilities and address complex analytics challenges. Moreover, the proliferation of digital technologies and the adoption of cloud computing are driving the demand for analytics solutions that can harness the power of big data, real-time analytics, and AI-driven insights. Additionally, regulatory compliance requirements and evolving consumer expectations are driving organizations to leverage analytics to enhance risk management, regulatory reporting, and customer experience.

The convergence of analytics with emerging technologies such as artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) is driving transformative changes in the BPO Business Analytics market. AI and ML algorithms enable predictive analytics, anomaly detection, and pattern recognition, empowering organizations to anticipate market trends, identify opportunities, and mitigate risks in real-time. Moreover, the integration of NLP technologies enables organizations to extract insights from unstructured data sources such as social media, customer feedback, and textual documents, enriching the depth and breadth of analytics insights. Furthermore, the adoption of automation and robotic process automation (RPA) streamlines analytics workflows, reduces manual effort, and enhances operational efficiency.

Regulatory compliance and data privacy considerations exert a significant influence on the BPO Business Analytics market dynamics. With the implementation of data protection regulations such as GDPR and CCPA, organizations are under increasing pressure to ensure the ethical use, protection, and governance of data processed by BPO Business Analytics providers. Consequently, BPO providers must adhere to stringent compliance standards, implement robust data security measures, and establish transparent data governance frameworks to safeguard sensitive information and mitigate regulatory risks. Moreover, there is a growing demand for BPO providers that offer domain-specific expertise and industry-specific knowledge to address sector-specific regulatory requirements and compliance challenges.

Market consolidation and strategic partnerships are prevalent trends shaping the BPO Business Analytics market dynamics. Mergers, acquisitions, and alliances among BPO service providers, consulting firms, and technology vendors enable them to expand their analytics capabilities, strengthen their market position, and access new industry verticals and geographic markets. Moreover, collaborations between BPO providers and technology vendors facilitate the integration of analytics solutions into existing business processes, platforms, and workflows, enabling organizations to derive actionable insights from data and drive business outcomes. These strategic alliances enable organizations to leverage the combined expertise, resources, and capabilities of multiple partners to address complex analytics challenges and unlock new value streams.

The global COVID-19 pandemic has accelerated the adoption of BPO Business Analytics solutions, as organizations seek to navigate unprecedented challenges, mitigate risks, and seize opportunities in a rapidly changing business environment. With the shift towards remote work, digital transformation, and virtual collaboration, there is an increasing demand for analytics solutions that enable organizations to monitor performance, optimize resources, and make data-driven decisions in real-time. Furthermore, the pandemic has underscored the importance of agility, resilience, and adaptability in business operations, driving organizations to leverage analytics to anticipate market trends, identify emerging risks, and capitalize on opportunities for growth and innovation.

Leave a Comment