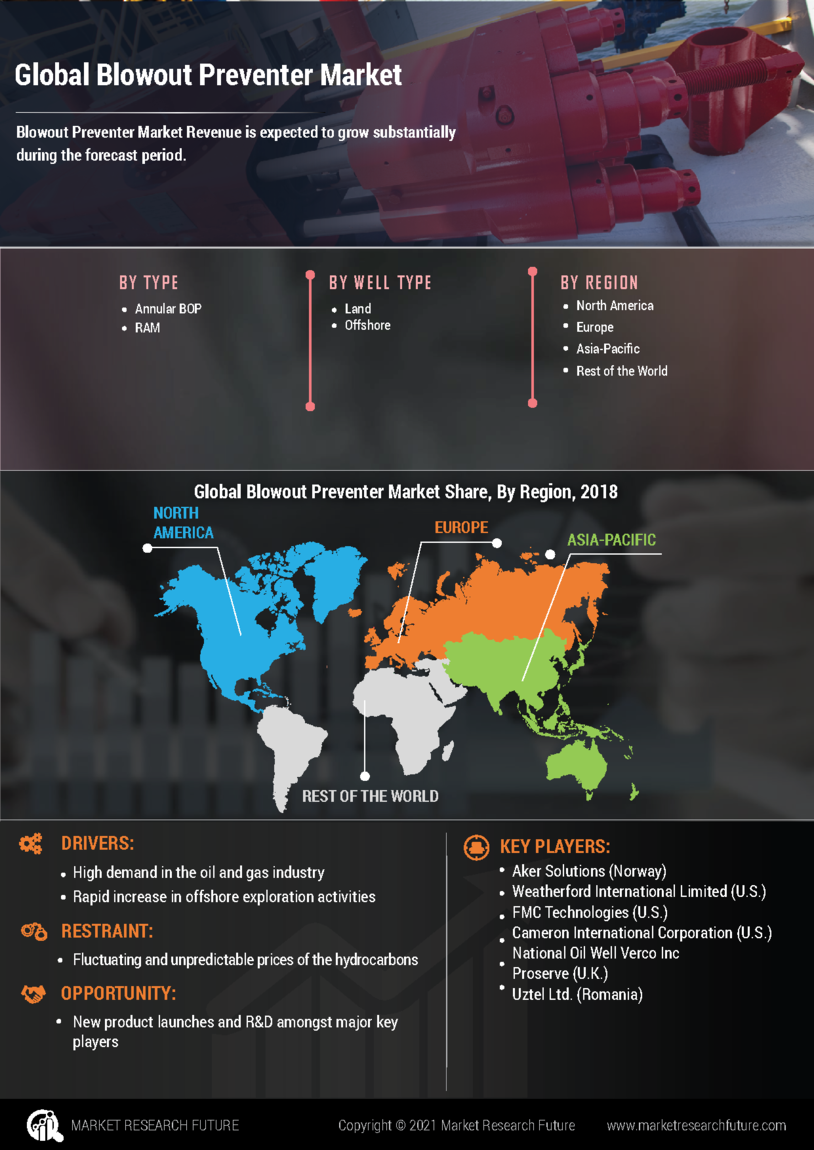

Increasing Demand for Safety Equipment

The Blowout Preventer Market is experiencing a surge in demand for safety equipment, driven by the need to mitigate risks associated with drilling operations. As exploration and production activities intensify, the emphasis on safety protocols has become paramount. Regulatory bodies are enforcing stricter safety standards, compelling operators to invest in advanced blowout preventers. This trend is reflected in the projected growth of the market, which is expected to reach USD 5 billion by 2026. The increasing awareness of safety measures among stakeholders further propels the demand for reliable blowout preventers, ensuring that the Blowout Preventer Market remains robust and responsive to evolving safety requirements.

Growing Investment in Oil and Gas Sector

The Blowout Preventer Market is benefiting from the growing investment in the oil and gas sector, as companies seek to enhance production capabilities and explore new reserves. Increased capital expenditure in upstream activities is driving the demand for blowout preventers, which are essential for safe drilling operations. As oil prices stabilize, operators are more inclined to invest in advanced technologies and equipment, including blowout preventers. Market forecasts indicate that investments in the oil and gas sector will rise by 8% annually, further stimulating the Blowout Preventer Market. This influx of capital is expected to foster innovation and improve the overall safety and efficiency of drilling operations.

Technological Innovations in Blowout Preventers

Technological advancements are reshaping the Blowout Preventer Market, as manufacturers strive to develop more efficient and reliable systems. Innovations such as remote monitoring, automated controls, and enhanced materials are being integrated into blowout preventers to improve performance and reduce failure rates. The introduction of smart blowout preventers, equipped with sensors and data analytics capabilities, is expected to enhance operational efficiency and safety. This technological evolution is anticipated to drive market growth, with investments in research and development projected to increase by 15% annually. As operators seek to optimize drilling operations, the Blowout Preventer Market is likely to benefit from these advancements.

Regulatory Pressures and Compliance Requirements

The Blowout Preventer Market is significantly influenced by regulatory pressures and compliance requirements imposed by governmental agencies. Stricter regulations aimed at preventing blowouts and ensuring environmental protection are compelling operators to upgrade their blowout preventer systems. Compliance with these regulations not only enhances safety but also mitigates potential financial liabilities associated with accidents. The market is expected to see a shift towards more advanced blowout preventers that meet or exceed regulatory standards. This trend is likely to drive market growth, with an estimated increase in compliance-related investments projected to reach USD 1.2 billion by 2027, highlighting the importance of regulatory frameworks in shaping the Blowout Preventer Market.

Rising Exploration Activities in Challenging Environments

The Blowout Preventer Market is witnessing growth due to the rising exploration activities in challenging environments, such as deepwater and ultra-deepwater drilling. These environments pose significant risks, necessitating the use of advanced blowout preventers to ensure operational safety. As oil and gas companies expand their exploration efforts into these areas, the demand for high-performance blowout preventers is expected to increase. Market analysts project that the segment for deepwater blowout preventers will grow at a CAGR of 10% over the next five years. This trend underscores the critical role of blowout preventers in safeguarding drilling operations in complex geological settings.