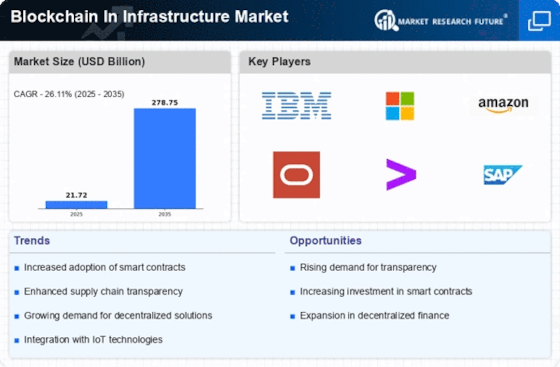

North America : Innovation and Leadership Hub

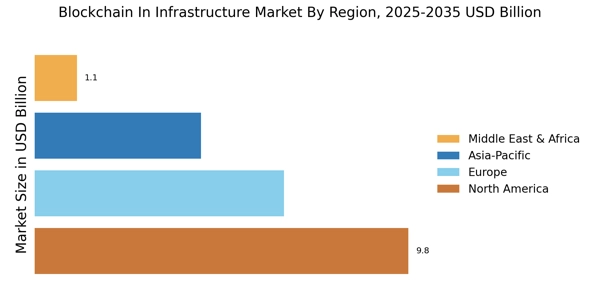

North America is the largest market for blockchain in infrastructure, holding approximately 45% of the global share. The region's growth is driven by increasing investments in blockchain technology, a robust regulatory framework, and a strong focus on innovation. The demand for secure and transparent systems in sectors like finance and supply chain is propelling market expansion. Regulatory support from agencies like the SEC is further catalyzing growth, ensuring compliance and fostering trust in blockchain applications.

The United States leads the market, with significant contributions from Canada. Major players such as IBM, Microsoft, and Amazon are headquartered here, driving competition and innovation. The presence of tech giants and startups alike fosters a vibrant ecosystem, encouraging collaboration and development. As companies increasingly adopt blockchain for infrastructure solutions, North America is set to maintain its leadership position in the coming years.

Europe : Emerging Blockchain Ecosystem

Europe is witnessing rapid growth in the blockchain infrastructure market, holding around 30% of the global share. The region benefits from strong regulatory frameworks, such as the EU's Digital Single Market strategy, which promotes digital innovation and blockchain adoption. Countries like Germany and France are leading the charge, with increasing investments in blockchain technology across various sectors, including finance, healthcare, and logistics. The European Blockchain Partnership is also a significant driver, fostering collaboration among member states.

Germany and the United Kingdom are at the forefront of this growth, with numerous startups and established companies exploring blockchain solutions. The competitive landscape is characterized by a mix of local and international players, including SAP and Accenture. As the region continues to embrace blockchain technology, the focus on sustainability and transparency will further enhance its market position, making Europe a key player in the global blockchain landscape.

Asia-Pacific : Rapid Adoption and Innovation

Asia-Pacific is rapidly emerging as a significant player in the blockchain infrastructure market, accounting for approximately 20% of the global share. The region's growth is driven by increasing digitalization, government initiatives, and a burgeoning startup ecosystem. Countries like China and India are leading the way, with substantial investments in blockchain technology across various sectors, including finance, supply chain, and healthcare. Regulatory support from governments is also enhancing market confidence and adoption rates.

China is particularly notable for its aggressive blockchain initiatives, with major companies like Alibaba and Huawei investing heavily in infrastructure solutions. India is also witnessing a surge in blockchain startups, supported by favorable government policies. The competitive landscape is diverse, with both established tech giants and innovative startups vying for market share. As the region continues to embrace blockchain technology, it is poised for significant growth in the coming years.

Middle East and Africa : Emerging Blockchain Frontier

The Middle East and Africa (MEA) region is gradually emerging in the blockchain infrastructure market, holding about 5% of the global share. The growth is primarily driven by increasing investments in technology and a focus on digital transformation across various sectors. Countries like the UAE and South Africa are leading the charge, with government initiatives promoting blockchain adoption in areas such as finance, logistics, and public services. The region's young population and increasing smartphone penetration are also contributing to the demand for innovative solutions.

The competitive landscape in MEA is characterized by a mix of local startups and international players. The UAE, in particular, is positioning itself as a blockchain hub, with initiatives like the Dubai Blockchain Strategy aiming to make Dubai the first city fully powered by blockchain. As more companies recognize the potential of blockchain technology, the MEA region is set to experience significant growth in the coming years, driven by innovation and collaboration.